Question: Dynamic - Problem and answer changes with each attempt (consider an Excel solution) Monet, Incorporated, is considering the purchase of a machine that would cost

Dynamic - Problem and answer changes with each attempt (consider an Excel solution)

Monet, Incorporated, is considering the purchase of a machine that would cost $ 546,512 and would last for 6 years, at the end of which, the machine would have a salvage value of $ 69,474. The machine would reduce labor and other costs by $ 115,729 per year. Additional working capital of $ 13,342 would be needed immediately, all of which would be recovered at the end of 6 years. The company requires a minimum pretax return of 0.11 on all investment projects. (Ignore income taxes.)

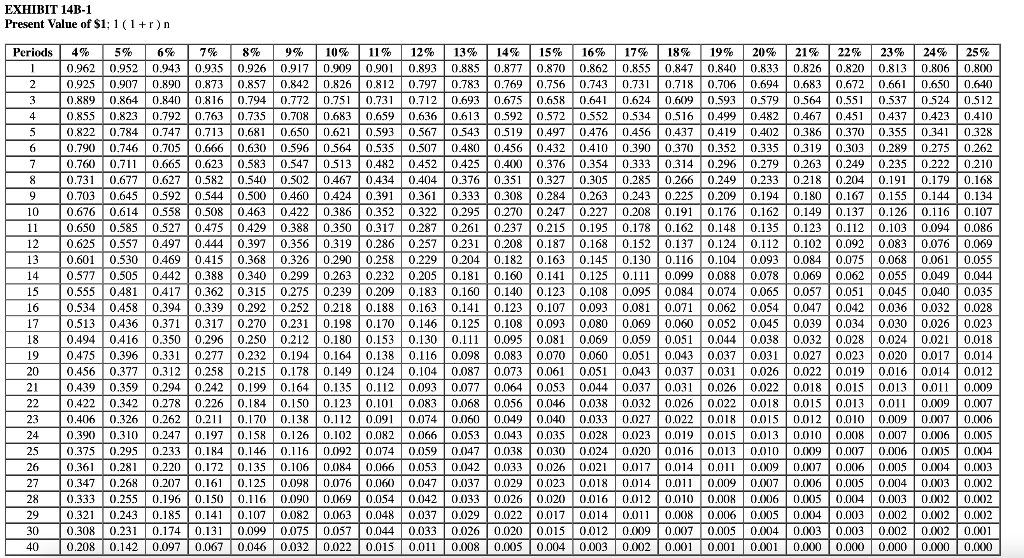

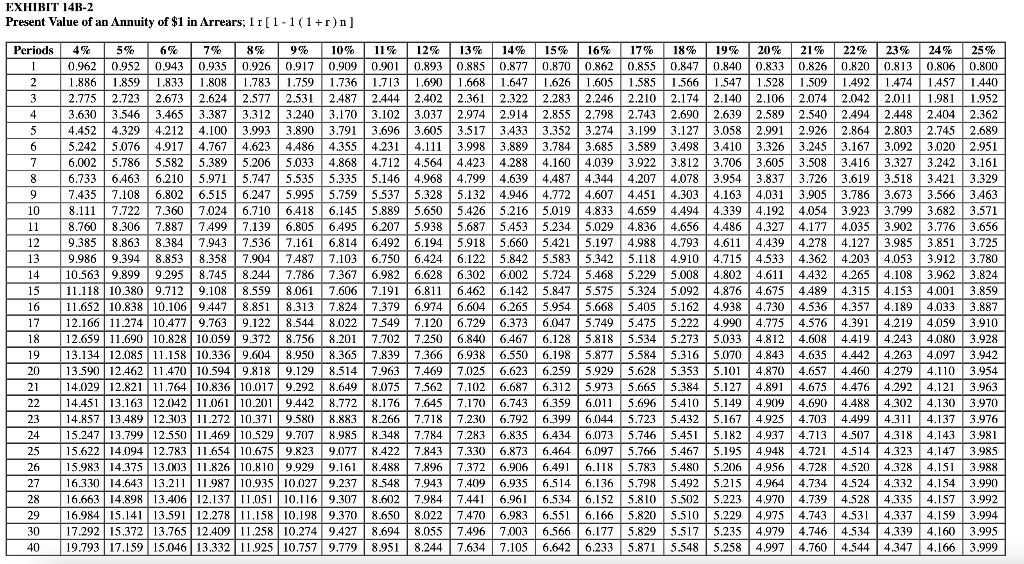

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.

or Use Excel NPV formula.

Required:

Determine the net present value of the project. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar amount.)

Dynamic - Problem and answer changes with each attempt (consider an Excel solution) Monet, Incorporated, is considering the purchase of a machine that would cost $546,512 and would last for 6 years, at the end of which, the machine would have a salvage value of $69,474. The machine would reduce labor and other costs by $115,729 per year. Additional working capital of $13,342 would be needed immediately, all of which would be recovered at the end of 6 years. The company requires a minimum pretax return of 0.11 on all investment projects. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. or Use Excel NPV formula. Required: Determine the net present value of the project. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar amount.) EXHIBIT 14B-1 Present Value of $1;1(1+r)n ' 14B-2 Present Value of an Annuity of $1 in Arrears; 1r[11(1+r)n ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts