Question: Dynamics Ltd is evaluating whether it should invest today in an equipment that costs $100,000. With the new machine, the firm projects it will be

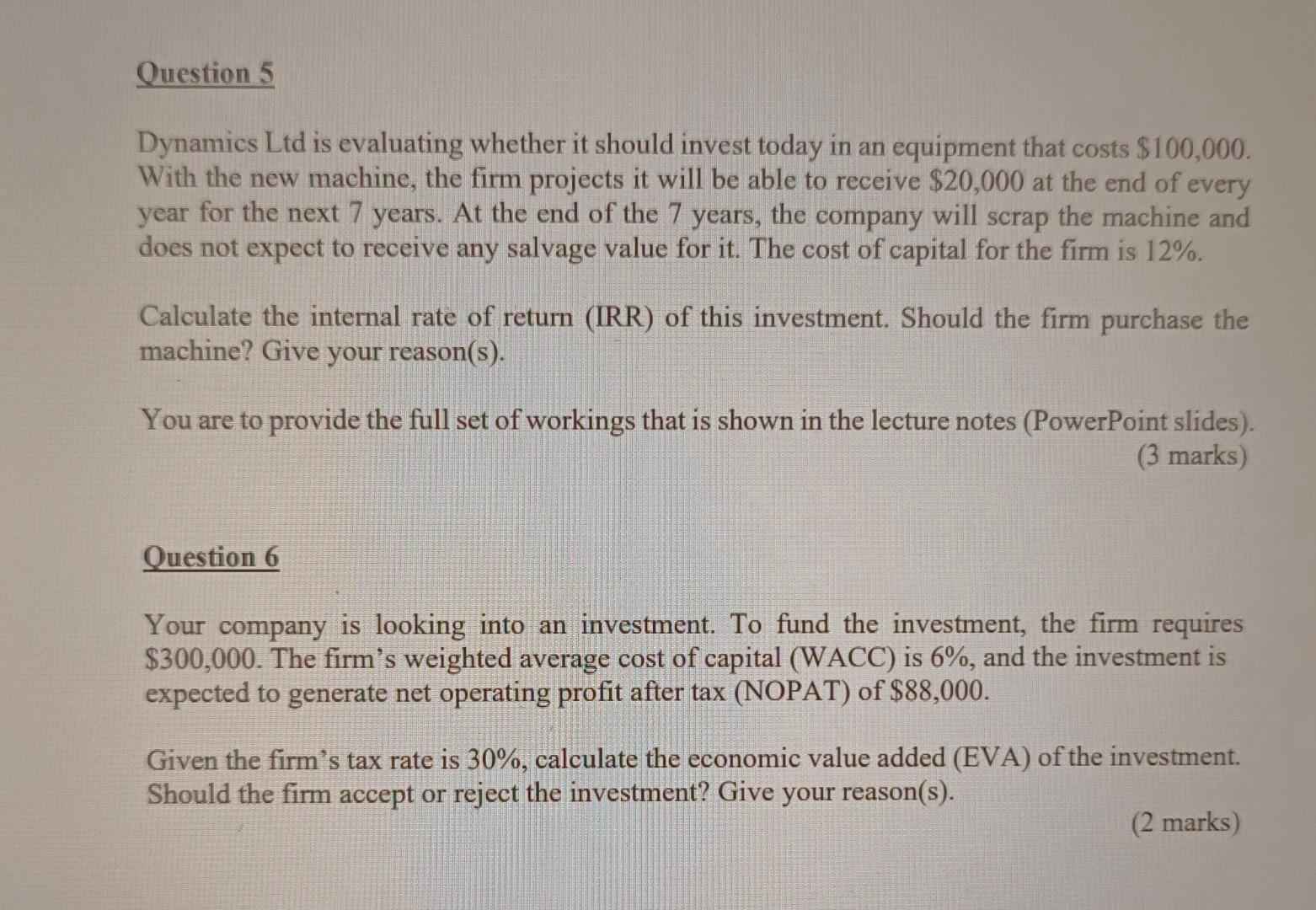

Dynamics Ltd is evaluating whether it should invest today in an equipment that costs $100,000. With the new machine, the firm projects it will be able to receive $20,000 at the end of every year for the next 7 years. At the end of the 7 years, the company will scrap the machine and does not expect to receive any salvage value for it. The cost of capital for the firm is 12%. Calculate the internal rate of return (IRR) of this investment. Should the firm purchase the machine? Give your reason(s). You are to provide the full set of workings that is shown in the lecture notes (PowerPoint slides). (3 marks) Question 6 Your company is looking into an investment. To fund the investment, the firm requires $300,000. The firm's weighted average cost of capital (WACC) is 6%, and the investment is expected to generate net operating profit after tax (NOPAT) of $88,000. Given the firm's tax rate is 30%, calculate the economic value added (EVA) of the investment. Should the firm accept or reject the investment? Give your reason(s). (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts