Question: E 1 1 - 6 ( Algo ) Comparing Options Using Present Value Concepts [ LO 1 1 - S 1 ] Ater hearing a

EAlgo Comparing Options Using Present Value Concepts LO S

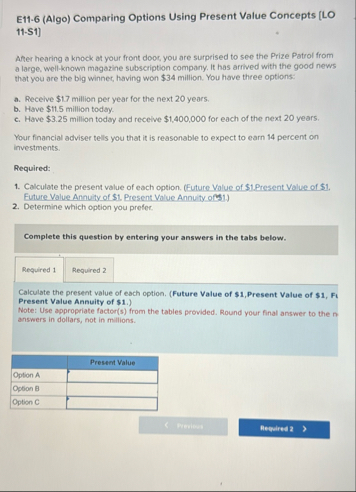

Ater hearing a knock at your front dooc you are surprised to see the Prize Patrol from a large, wellknown magazine subscription company, It has arrived with the good news that you are the blig winner, having won $ mitilon, You hove three options:

a Recelve $ million per year for the next years.

b Have $ million today.

c Have $ million today and recelve $ for each of the next years.

Your financial adviser tells you that it is reasonable to expect to earn percent on investments.

Required:

Calculate the present value of each option. Euture Value of $Present Value of $ Euture Value Annuity of $ Present Value Annu ty oCS

Determine which option you prefer.

Complete this question by entering your answers in the tabs below.

Required

Calculate the present value of each option. Future Value of $ Present Value of $ Present Value Annuity of $

Note: Use appropriate factors from the tables provided. Round your finat answer to the n answers in dollars, not in millions.

tablePresent ValueOption AOption BOption C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock