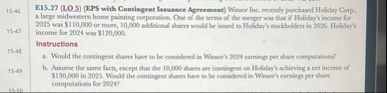

Question: E 1 5 . 2 7 ( L . 0 . 5 ) ( EPS with Contingent Issuance Agreement ) Wirear Inc. mennely parchased Holiday

ELEPS with Contingent Issuance Agreement Wirear Inc. mennely parchased Holiday Corp. a large midurestern home painting coeperation. One of the vermas of the merger was that if Holiday's income for was $ or more, addidional shares would be insed so Holichy's stockbolders in Holidry's income for was $

Instructions

a Woald the centingent shares have to be comidered in Winear' earning per share computation?

b Asume the same facts, escept that the shares are boadingene on Holiday's achieving a net income of $ in Would the contingent shares hae to be considered in Winuor' earning per slare computaticas for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock