Question: E 1 6 - 2 5 . Computing Break - Even and Margin of Safety L 0 1 6 - 3 Assume that last year,

E Computing BreakEven and Margin of Safety

L

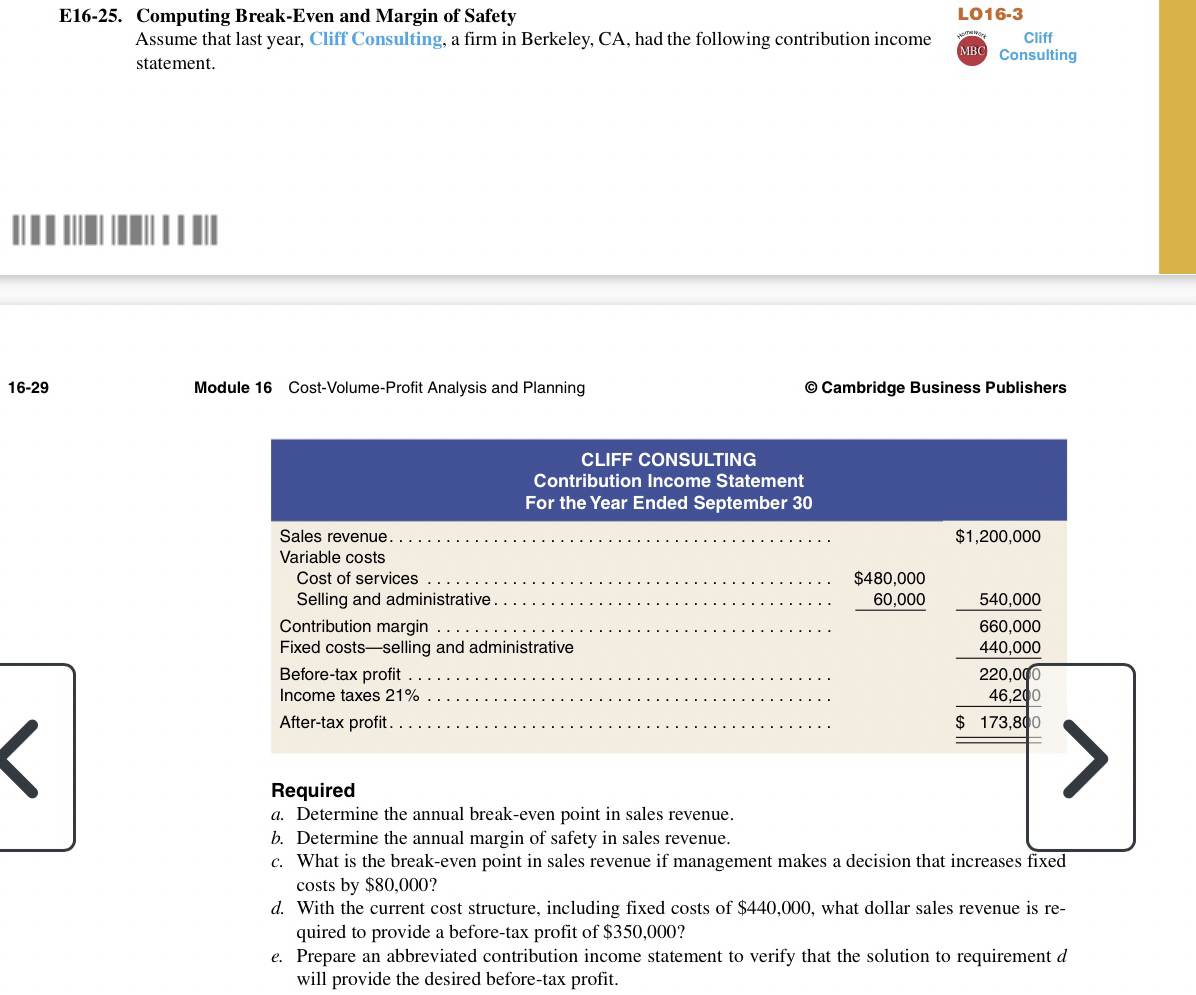

Assume that last year, Cliff Consulting, a firm in Berkeley, CA had the following contribution income statement.

MBC Consulting

Module CostVolumeProfit Analysis and Planning

c Cambridge Business Publishers

CLIFF CONSULTING

Contribution Income Statement

For the Year Ended September

Sales revenue.

Variable costs

Cost of services

Selling and administrative.

Contribution margin

Fixed costsselling and administrative

Beforetax profit

Income taxes

Aftertax profit.

$

table$

$

Required

a Determine the annual breakeven point in sales revenue.

b Determine the annual margin of safety in sales revenue.

c What is the breakeven point in sales revenue if management makes a decision that increases fixed costs by $

d With the current cost structure, including fixed costs of $ what dollar sales revenue is required to provide a beforetax profit of $

Prepare an abbreviated contribution income statement to verify that the solution to requirement will provide the desired beforetax profit.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock