Question: E 1 6 - 2 6 Net operating loss carryback and carryforward; financial statement effects 2 LO 1 6 - 7 [ This exercise is

E Net operating loss carryback and carryforward; financial statement effects LO

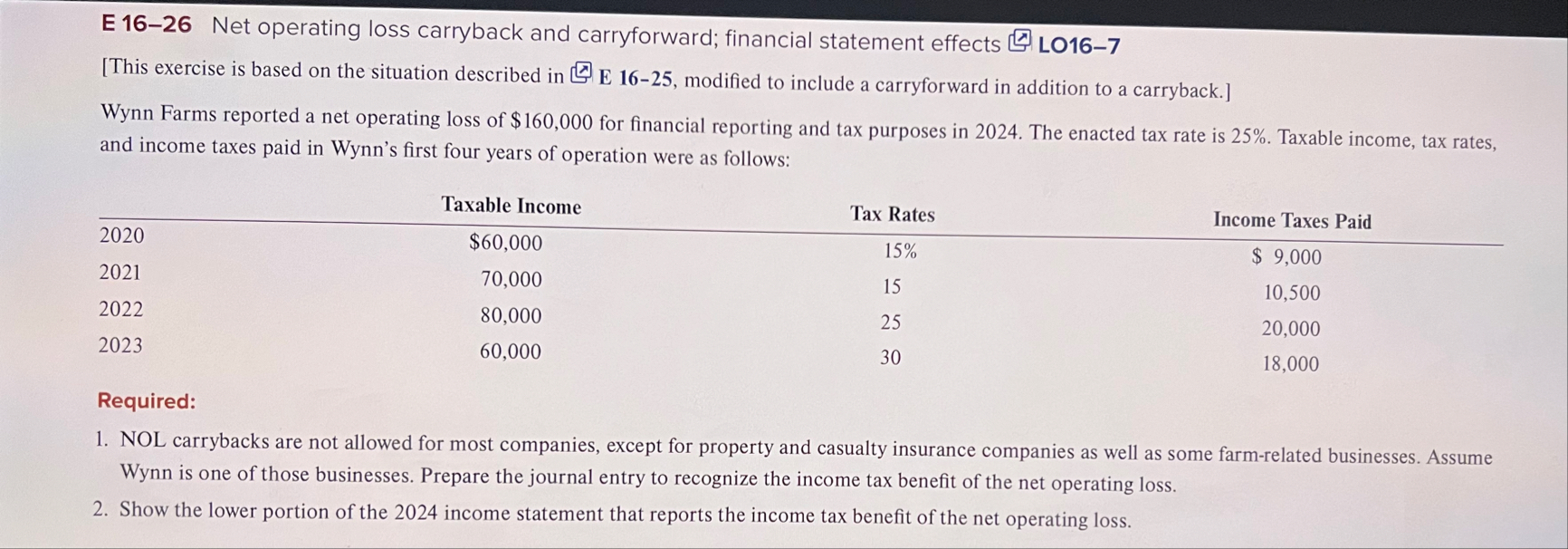

This exercise is based on the situation described in modified to include a carryforward in addition to a carryback.

Wynn Farms reported a net operating loss of $ for financial reporting and tax purposes in The enacted tax rate is Taxable income, tax rates, and income taxes paid in Wynns first four years of operation were as follows:

tableTaxable Income,Tax Rates,Income Taxes Paid$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock