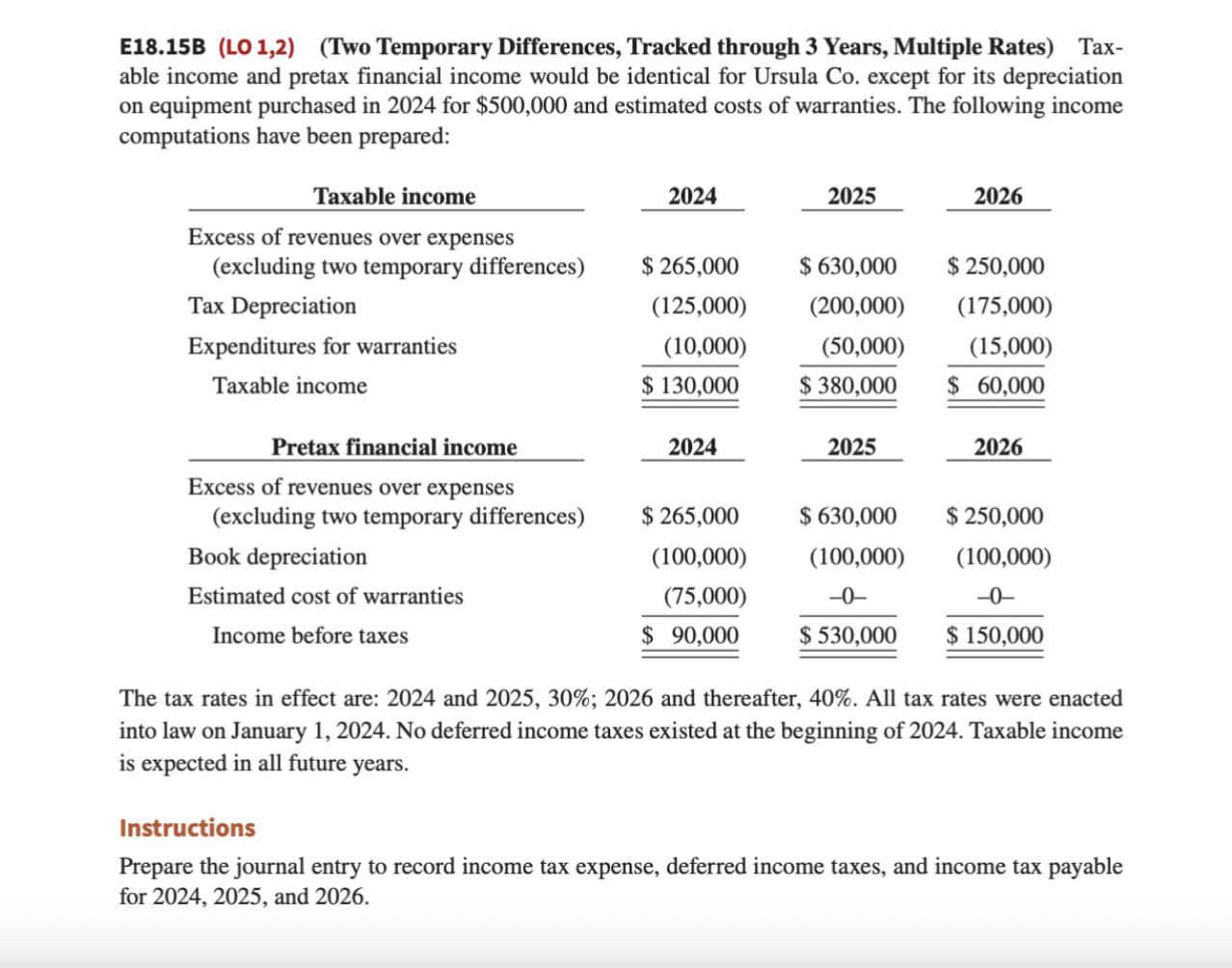

Question: E 1 8 . 1 5 B ( LO 1 , 2 ) ( Two Temporary Differences, Tracked through 3 Years, Multiple Rates ) Taxable

EB LO Two Temporary Differences, Tracked through Years, Multiple Rates Taxable income and pretax financial income would be identical for Ursula Co except for its depreciation on equipment purchased in for $ and estimated costs of warranties. The following income computations have been prepared:Excess of revenues over expenses excluding two temporary differencesExcess of revenues over expenses excluding two temporary differences The tax rates in effect are: and ; and thereafter, All tax rates were enacted into law on January No deferred income taxes existed at the beginning of Taxable income is expected in all future years. Instructions Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock