Question: E 1 8 . 6 ( LO 1 , 2 ) ( Identify Temporary or Permanent Differences ) Listed below are items that are commonly

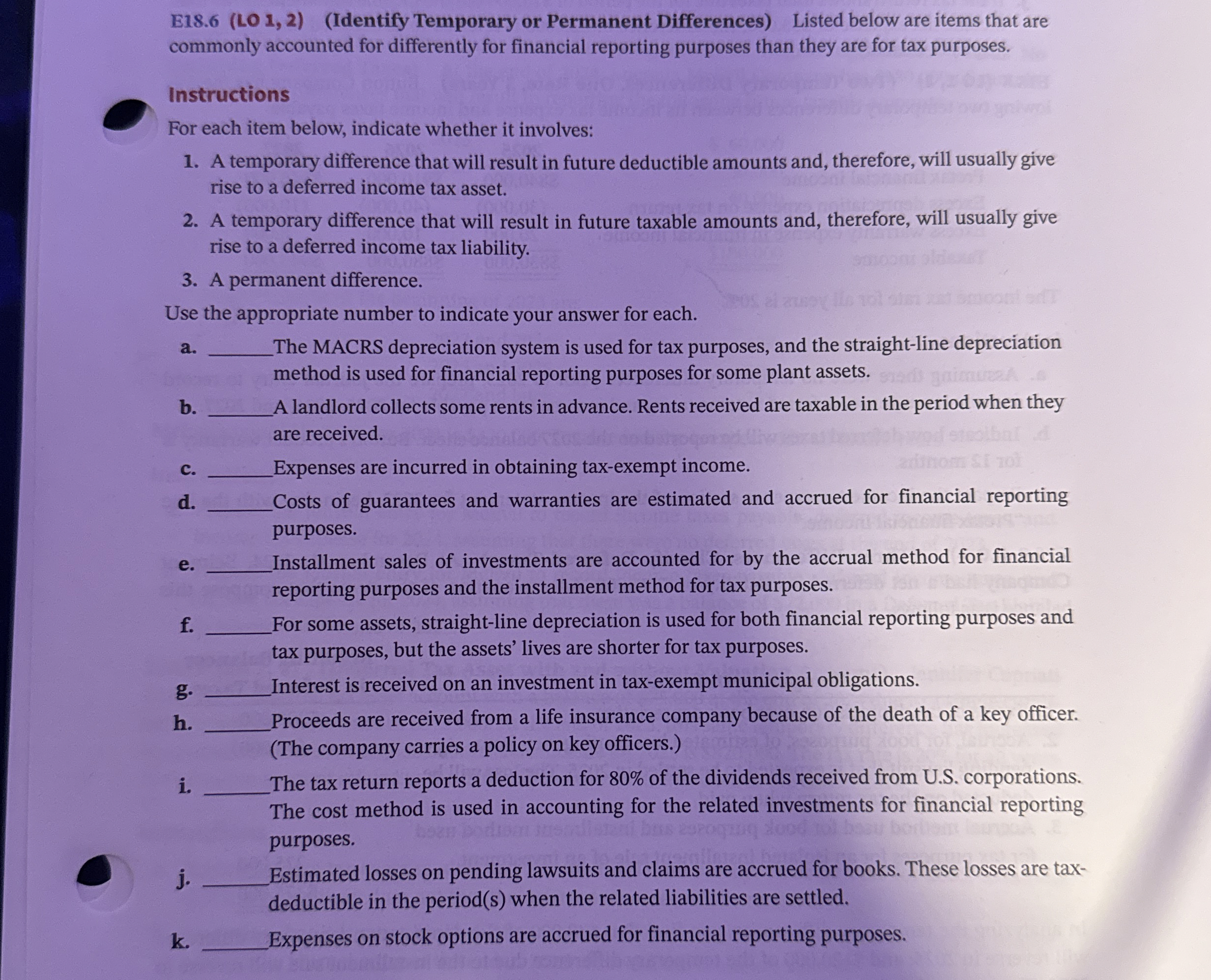

ELO Identify Temporary or Permanent Differences Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.

Instructions

For each item below, indicate whether it involves:

A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset.

A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability.

A permanent difference.purposes.j qquad Estimated losses on pending lawsuits and claims are accrued for books. These losses are taxdeductible in the periods when the related liabilities are settled.k qquad Expenses on stock options are accrued for financial reporting purposes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock