Question: E 11-10 Double-declining-balance method; switch to straight line L.O1 1-2. LO11-6 January 2, Company purchased equipment to be used in its value of process. equipment

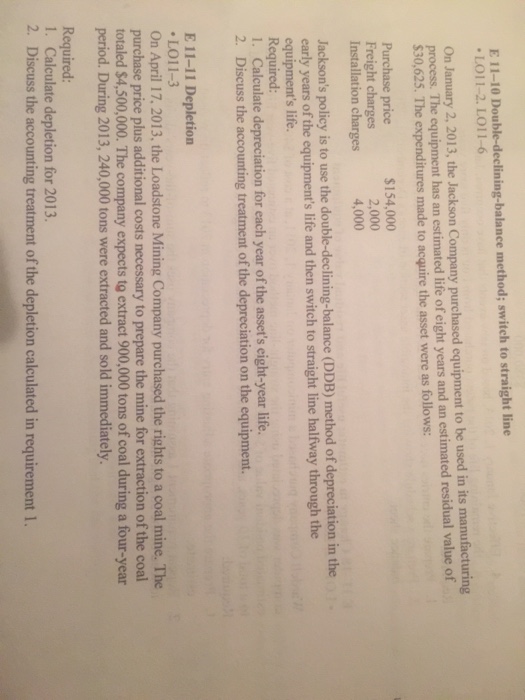

E 11-10 Double-declining-balance method; switch to straight line L.O1 1-2. LO11-6 January 2, Company purchased equipment to be used in its value of process. equipment has an estimated life years an estimated residual 0,625. The expenditures made to acquire the asset were as follows: $154,000 Purchase price 2,000 Freight charges 4,000 Installation charges Jackson's policy is to use the double-declining-balance method of in the early years of the equipment's life and then switch to straight line halfway through the equipment's life. Required: 1. Calculate depreciation for each year of the asset's eight-year life. 2. Discuss the accounting treatment of the depreciation on the equipment. E 11-11 Depletion LO11 On April 17. 2013, the Loadstone Mining Company purchased the rights to a coal mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the coal totaled $4,500,000. The company expects to extract 900,000 tons of coal during a four-year period. During 2013, 240,000 tons were extracted and sold immediately. Required 1. Calculate depletion for 2013. 2. Discuss the accounting treatment of the depletion calculated in requirement 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts