Question: E. 11.2% E. 231,800 D. 36% E. 63.1% D. 140,250 E. 125,250 Kragle Corporation reported the following financial data for one of its divisions for

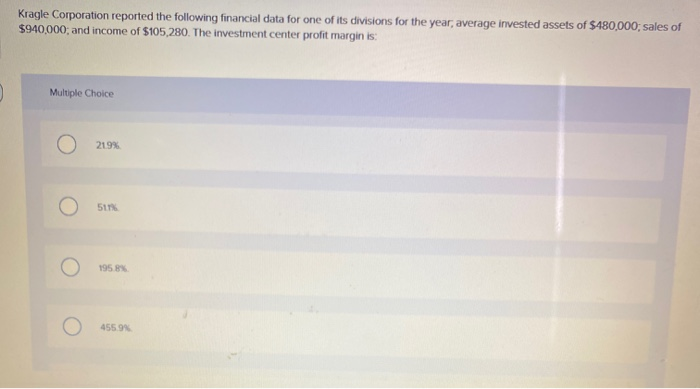

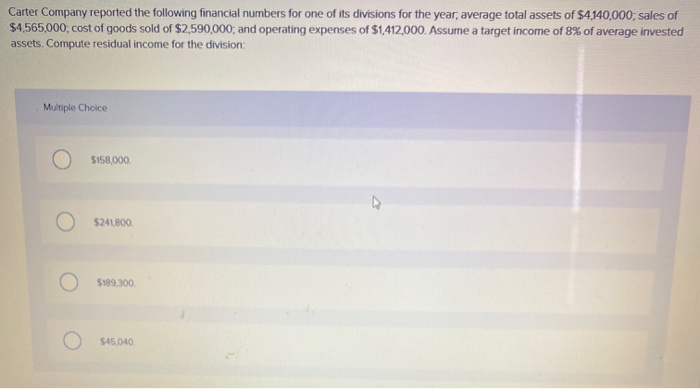

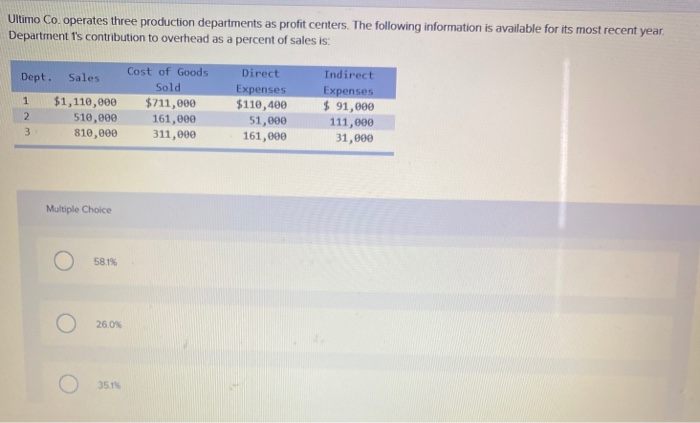

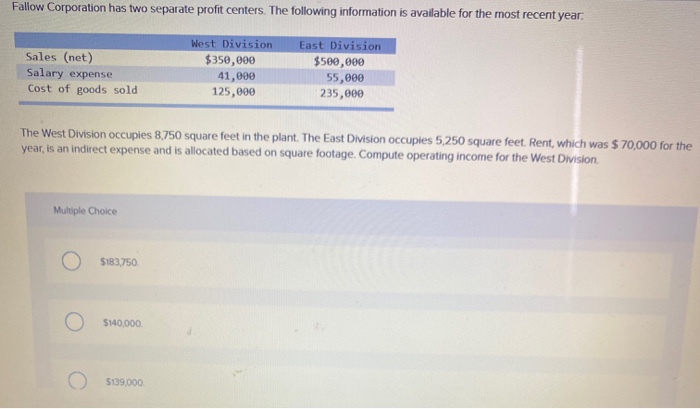

Kragle Corporation reported the following financial data for one of its divisions for the year, average invested assets of $480,000, sales of $940,000, and income of $105,280. The investment center profit margin is: Multiple Choice Carter Company reported the following financial numbers for one of its divisions for the year, average total assets of $4.140,000, sales of $4,565,000, cost of goods sold of $2,590,000, and operating expenses of $1,412,000. Assume a target income of 8% of average invested assets. Compute residual income for the division: Multiple Choice O $158,000 o o O $241800 O $199.300 O S45,040 $45.040 Ultimo Co operates three production departments as profit centers. The following information is available for its most recent year Department I's contribution to overhead as a percent of sales is: Dept. Sales 1 $1,110,000 510,000 810,000 Cost of Goods Sold $711,000 161,000 311,000 Direct Expenses $110,400 51,000 161,000 Indirect Expenses $ 91,000 111,000 31,000 Multiple Choice o oo Fallow Corporation has two separate profit centers. The following information is available for the most recent year: Sales (net) Salary expense Cost of goods sold West Division $350,000 41,000 125,000 East Division $500,000 55,000 235,000 The West Division occupies 8,750 square feet in the plant. The East Division occuples 5,250 square feet. Rent, which was $ 70,000 for the year, is an indirect expense and is allocated based on square footage Compute operating income for the West Division Multiple Choice O $183750 O $140,000 0 $139,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts