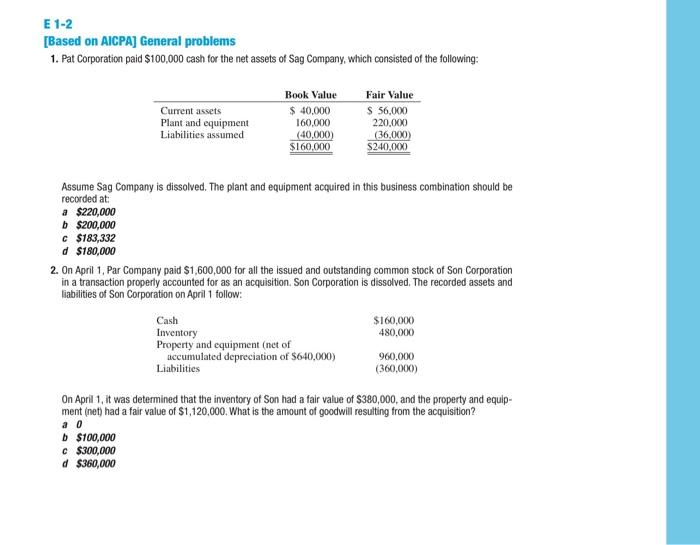

Question: E 1-2 [Based on AICPA) General problems 1. Pat Corporation paid $100,000 cash for the net assets of Sag Company, which consisted of the following:

E 1-2 [Based on AICPA) General problems 1. Pat Corporation paid $100,000 cash for the net assets of Sag Company, which consisted of the following: Current assets Plant and equipment Liabilities assumed Book Value $ 40,000 160.000 (40,000) $160,000 Fair Value $ 56,000 220,000 (36,000) $240,000 Assume Sag Company is dissolved. The plant and equipment acquired in this business combination should be recorded at: a $220,000 b$200,000 C$183,332 d $180,000 2. On April 1, Par Company paid $1,600,000 for all the issued and outstanding common stock of Son Corporation in a transaction properly accounted for as an acquisition. Son Corporation is dissolved. The recorded assets and liabilities of Son Corporation on April 1 follow: Cash $160,000 Inventory 480,000 Property and equipment (net of accumulated depreciation of S640,000) 960.000 Liabilities (360,000) a 0 On April 1, it was determined that the inventory of Son had a fair value of $380,000, and the property and equip- ment (net) had a fair value of $1,120,000. What is the amount of goodwill resulting from the acquisition? b$100,000 C$300,000 d $360,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts