Question: E 14-6 Acquisition-Excess allocation and amortization effect Pal acquired all the stock of Sta of Britain on January 1, 2011, for $163,800, when Sta had

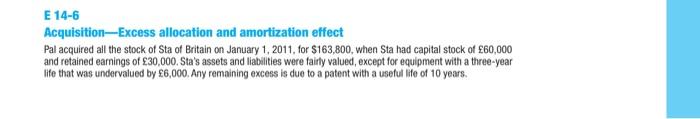

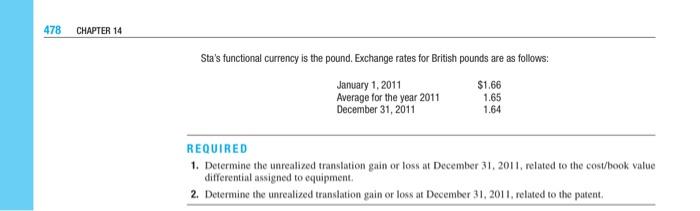

E 14-6 Acquisition-Excess allocation and amortization effect Pal acquired all the stock of Sta of Britain on January 1, 2011, for $163,800, when Sta had capital stock of 60,000 and retained earnings of 30,000. Sta's assets and liabilities were fairly valued, except for equipment with a three-year life that was undervalued by 6,000. Any remaining excess is due to a patent with a useful life of 10 years. a 478 CHAPTER 14 Sta's functional currency is the pound. Exchange rates for British pounds are as follows: January 1, 2011 $1.66 Average for the year 2011 1.65 December 31, 2011 1.64 REQUIRED 1. Determine the unrealized translation gain or loss at December 31, 2011, related to the cost/book value differential assigned to equipment 2. Determine the unrealized translation gain or loss at December 31, 2011 related to the patent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts