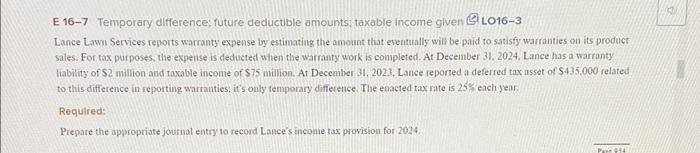

Question: E 16-7 Temporary difference; future deductible amounts; taxable income given 1 LO16-3 Lance Lawn Services reports warranty expense by estimating the amount that eventually will

E 16-7 Temporary difference; future deductible amounts; taxable income given 1 LO16-3 Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31. 2024, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2023, Lance reported a deferred tax asset of $435,000 related to this difference in reporting warnuties, if's only femporary difference. The enacted tax rate is 255 each year. Requlred: Prepare the appropriate journal entry to record Lance s incone tax provision for 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts