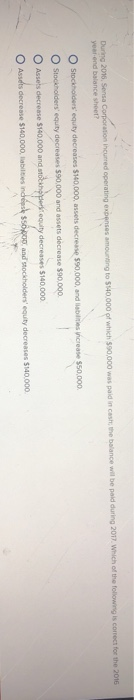

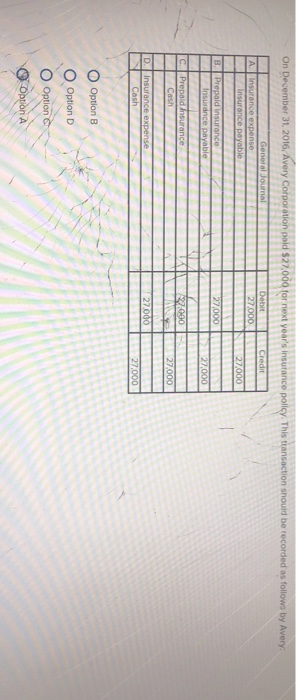

Question: e 2016 O Stockhoiders equity decreases $40,000, assets decrease decreases $140,000 sS0RO0, and stockholders' equity decreases $140.000 27.000 O Option Lantz Company has provided the

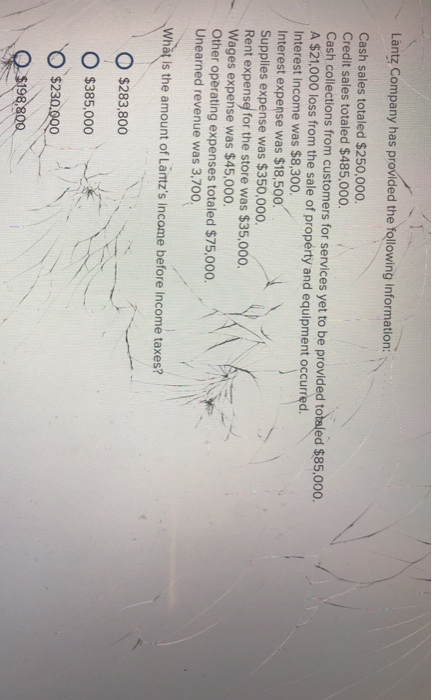

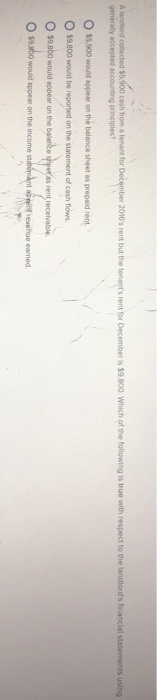

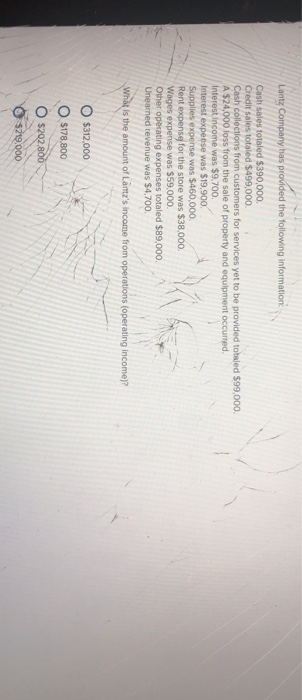

e 2016 O Stockhoiders equity decreases $40,000, assets decrease decreases $140,000 sS0RO0, and stockholders' equity decreases $140.000 27.000 O Option Lantz Company has provided the following information: Cash sales totaled $250,000. Credit sales totaled $485,000 Cash collections from customers for services yet to be provided totaled $85,000. A $21,000 loss from the sale of property and equipment occurred. Interest income was $8,300. Interest expense was $18,500 Supplies expense was $350,000. Rent expense for the store was $35,000. Wages expense was $45,000. Other operating expenses totaled $75,000. Unearned revenue was 3,700 What Is the amount of Lamtz's income before iIncome taxes? O $283,800 . $385,000 O O O C Cash sales totaled $390,000. Credit sales totaled $499,000. Cash collections from customers for services yet to be provided totsled $99,000. A $24,000 loss from the sale of property and equipment occuned Interest Income was $9,700 Interest expense was $19,900 Supplies expense was $460,000. Rent expense for the store was $38,000 Wages expense was $59,000. Other operating expenses totaled $89,000. Unearned revenue was $4,700. O $312.000 O $178.800 O $202.800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts