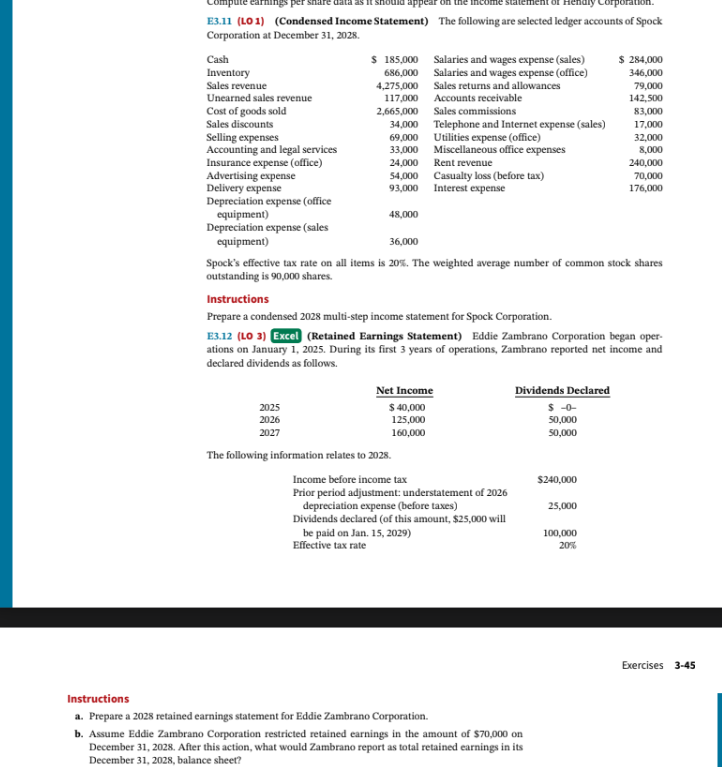

Question: E 3 . 1 1 ( LO 1 ) ( Condensed Income Statement ) The following are selected ledger accounts of Spock Corporation at December

ELO Condensed Income Statement The following are selected ledger accounts of Spock Corporation at December Cash $ Salaries and wages expense sales $ Inventory Salaries and wages expense office Sales revenue Sales returns and allowances Unearned sales revenue Accounts receivable Cost of goods sold Sales commissions Sales discounts Telephone and Internet expense sales Selling expenses Utilities expense office Accounting and legal services Miscellaneous office expenses Insurance expense office Rent revenue Advertising expense Casualty loss before tax Delivery expense Interest expense Depreciation expense office equipment Depreciation expense sales equipment Spocks effective tax rate on all items is The weighted average number of common stock shares outstanding is shares. Instructions Prepare a condensed multistep income statement for Spock Corporation. ELO Excel Retained Earnings Statement Eddie Zambrano Corporation began oper ations on January During its first years of operations, Zambrano reported net income and declared dividends as follows. Net Income Dividends Declared $ $ The following information relates to Income before income tax $ Prior period adjustment: understatement of depreciation expense before taxes Dividends declared of this amount, $ will be paid on Jan. Effective tax rate Instructions a Prepare a retained earnings statement for Eddie Zambrano Corporation. b Assume Eddie Zambrano Corporation restricted retained earnings in the amount of $ on December After this action, what would Zambrano report as total retained earnings in its December balance sheet?

E Hints:

Supporting computations: abcd

a Net sales:

$ $ $

b Cost of goods sold:

$$ $ $ $ $

c Selling expenses:

$ $ $ $ $ $ $

d Administrative expenses:

$ $ $ $ $ $

E Hints:

Jan Balance: $ $ $$ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock