Question: E 3 - 9 ( Static ) Analyzing the Effects of Transactions in T - Accounts LO 3 - 3 , 3 - 4 Stacey's

EStatic Analyzing the Effects of Transactions in TAccounts LO

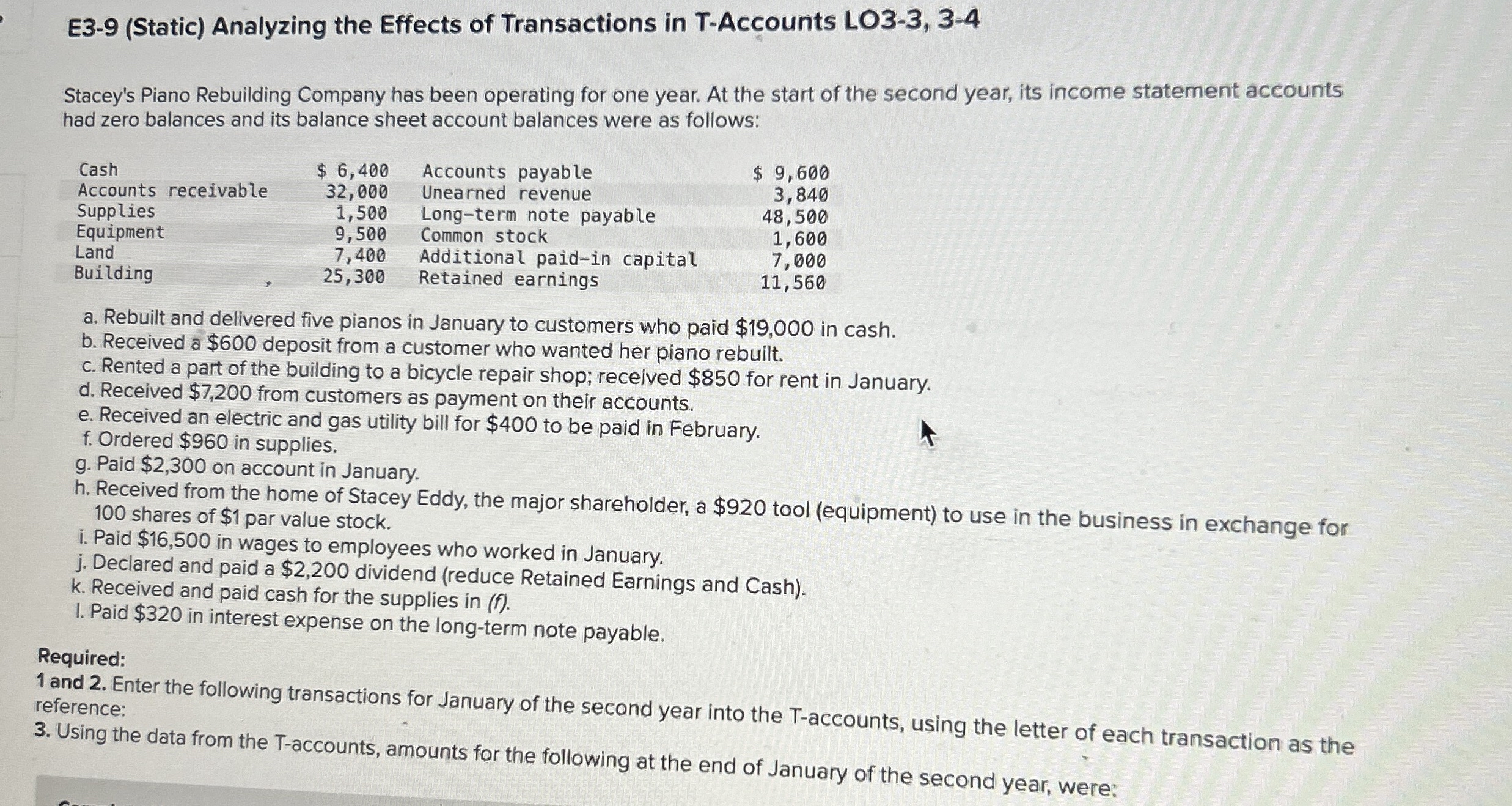

Stacey's Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts

had zero balances and its balance sheet account balances were as follows:

a Rebuilt and delivered five pianos in January to customers who paid $ in cash.

b Received a $ deposit from a customer who wanted her piano rebuilt.

c Rented a part of the building to a bicycle repair shop; received $ for rent in January.

d Received $ from customers as payment on their accounts.

e Received an electric and gas utility bill for $ to be paid in February.

f Ordered $ in supplies.

g Paid $ on account in January.

h Received from the home of Stacey Eddy, the major shareholder, a $ tool equipment to use in the business in exchange for

shares of $ par value stock.

i Paid $ in wages to employees who worked in January.

j Declared and paid a $ dividend reduce Retained Earnings and Cash

k Received and paid cash for the supplies in

I. Paid $ in interest expense on the longterm note payable.

Required:

and Enter the following transactions for January of the second year into the Taccounts, using the letter of each transaction as the

reference:

Using the data from the Taccounts, amounts for the following at the end of January of the second year, were:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock