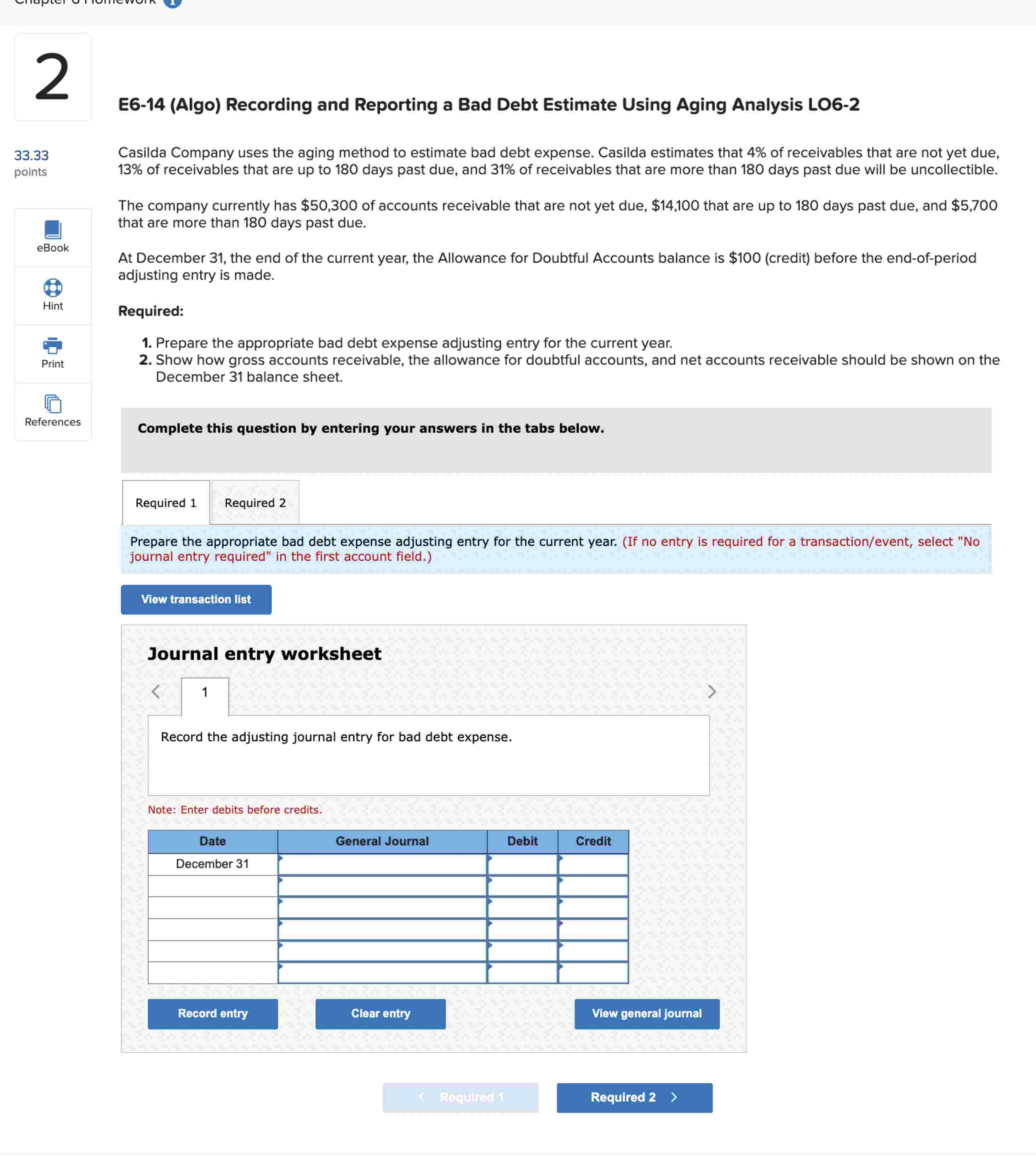

Question: E 6 - 1 4 ( Algo ) Recording and Reporting a Bad Debt Estimate Using Aging Analysis L 0 6 - 2 Casilda Company

EAlgo Recording and Reporting a Bad Debt Estimate Using Aging Analysis L

Casilda Company uses the aging method to estimate bad debt expense. Casilda estimates that of receivables that are not yet due,

of receivables that are up to days past due, and of receivables that are more than days past due will be uncollectible.

The company currently has $ of accounts receivable that are not yet due, $ that are up to days past due

that are more than days past due.

At December the end of the current year, the Allowance for Doubtful Accounts balance is $credit before the endofperiod

adjusting entry is made.

Required:

Prepare the appropriate bad debt expense adjusting entry for the current year.

Show how gross accounts receivable, the allowance for doubtful accounts, and net accounts receivable should be shown on the

December balance sheet.

Complete this question by entering your answers in the tabs below.

Prepare the appropriate bad debt expense adjusting entry for the current year. If no entry is required for a transactionevent select No

journal entry required" in the first account field.

Journal entry worksheet

Record the adjusting journal entry for bad debt expense.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock