Question: E 7 - 5 ( Algo ) Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost LO 7 - 2

EAlgo Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost

LO

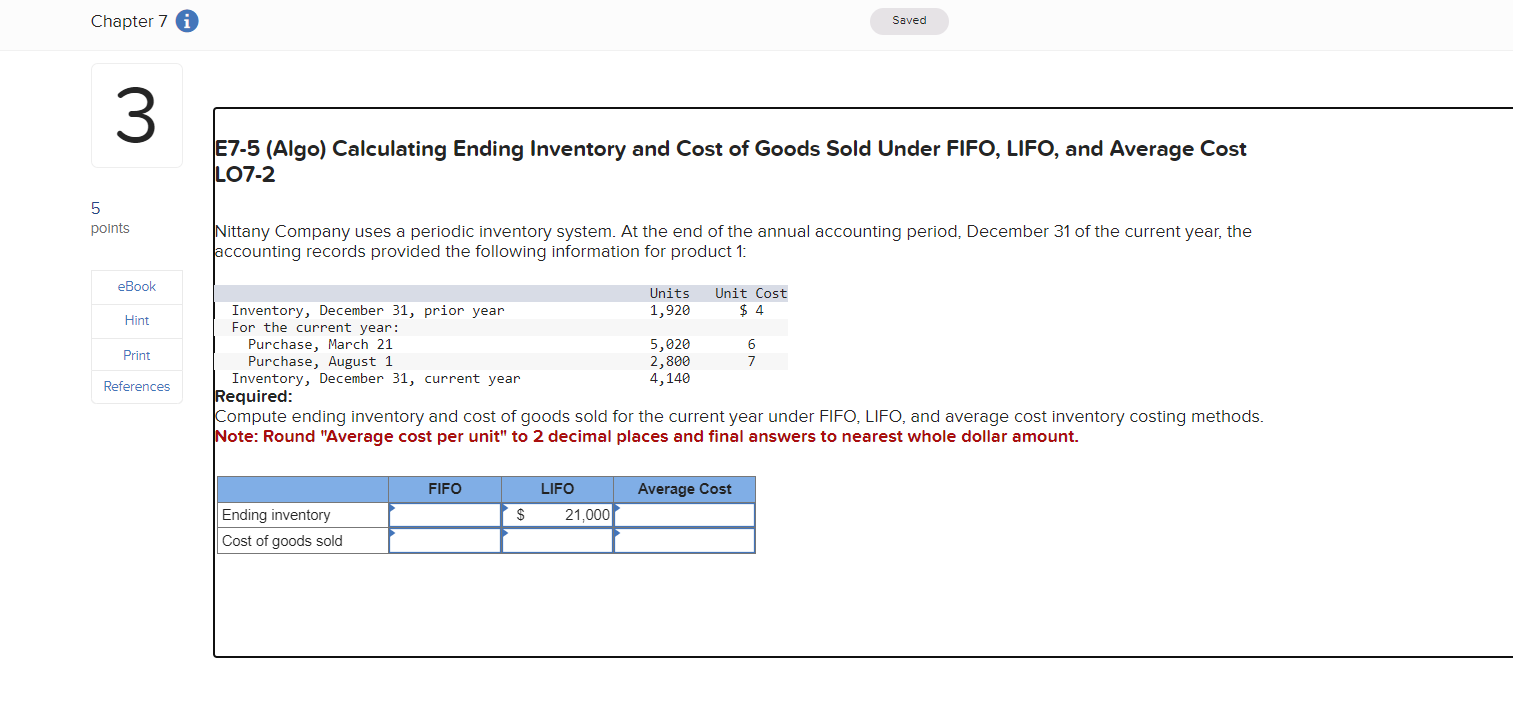

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the

accounting records provided the following information for product :

Inventory, December prior year

For the current year:

Purchase, March

Purchase, August

Inventory, December current year

Required:

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

Note: Round "Average cost per unit" to decimal places and final answers to nearest whole dollar amount.Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the accounting records provided the following information for product :

Units Unit Cost

Inventory, December prior year $

For the current year:

Purchase, March

Purchase, August

Inventory, December current year

Required:

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

Note: Round "Average cost per unit" to decimal places and final answers to nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock