Question: E 7 - 7 ( Algo ) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO 7 - 2 , 7 -

EAlgo Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO

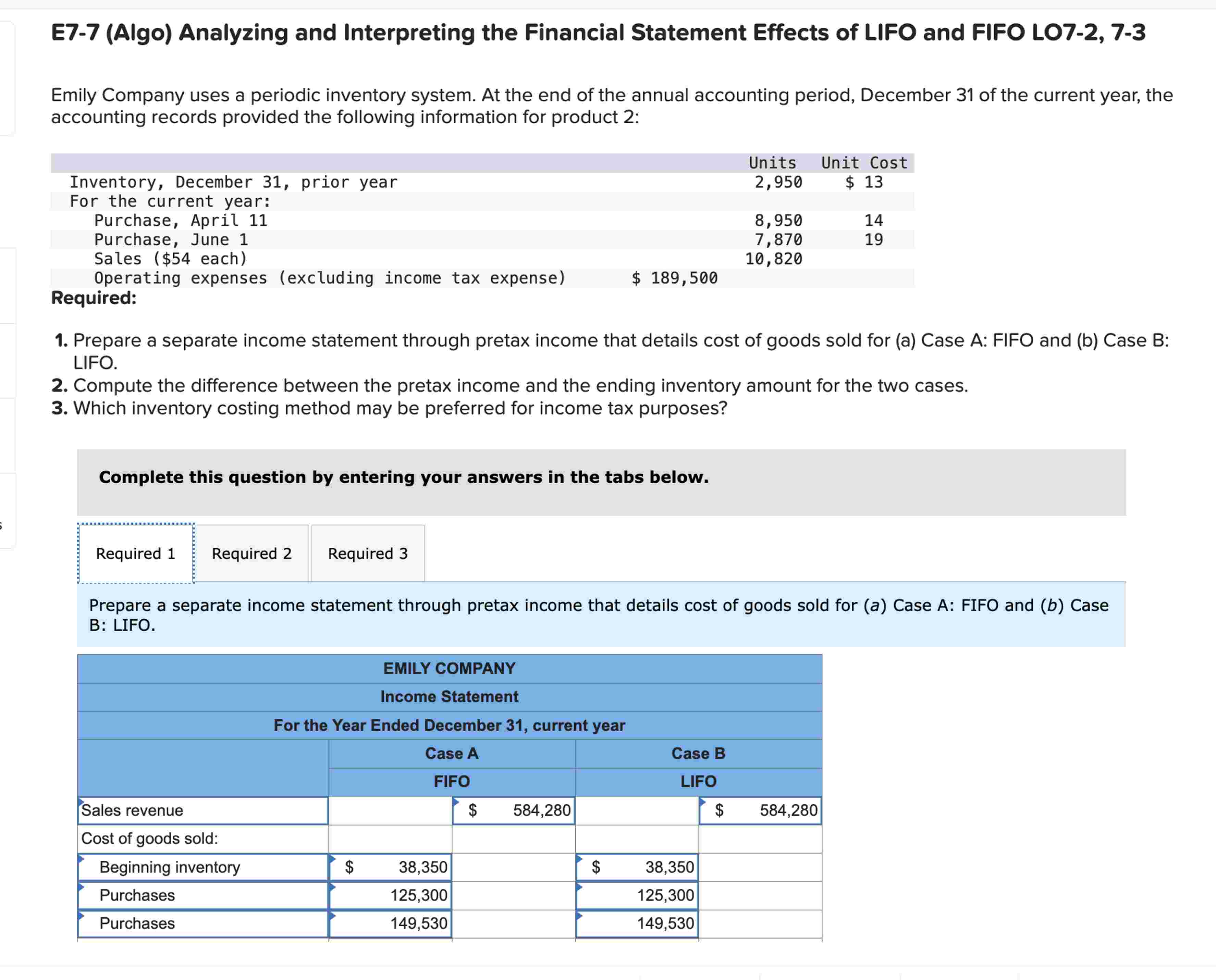

Emily Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the accounting records provided the following information for product :

Required:

Prepare a separate income statement through pretax income that details cost of goods sold for a Case A: FIFO and b Case B: LIFO.

Compute the difference between the pretax income and the ending inventory amount for the two cases.

Which inventory costing method may be preferred for income tax purposes?

Complete this question by entering your answers in the tabs below.

Required

Required

Prepare a separate income statement through pretax income that details cost of goods sold for a Case A: FIFO and b Case B: LIFO. Complete this question by entering your answers in the tabs below.

Required

Required

Prepare a separate income statement through pretax income that details cost of goods sold for a Case A: FIFO and b Case B: LIFO. EAlgo Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO

Emily Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the

accounting records provided the following information for product :

Emily Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the

accounting records provided the following information for product :

Required:

Prepare a separate income statement through pretax income that details cost of goods sold for a Case A: FIFO and b Case B: LIFO.

Compute the difference between the pretax income and the ending inventory amount for the two cases.

Which inventory costing method may be preferred for income tax purposes?

Complete this question by entering your answers in the tabs below.

Required

Required

Compute the difference between the pretax income and the ending inventory amount for the two cases.

Note: Loss amounts should be indicated with a minus sign.

EAlgo Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO

Emily Company uses a periodic inventory system. At the end of the annual accounting period, December of the current year, the accounting records provided the following information for product :

Required:

Prepare a separate income statement through pretax income that details cost of goods sold for a Case A: FIFO and b Case B: LIFO.

Compute the difference between the pretax income and the ending inventory amount for the two cases.

Which inventory costing method may be preferred for income tax purposes?

Complete this question by entering your answers in the tabs below.

Required

Which inventory costing method may be preferred for income tax purposes?

Which inventory costing method may be preferred for income tax purposes?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock