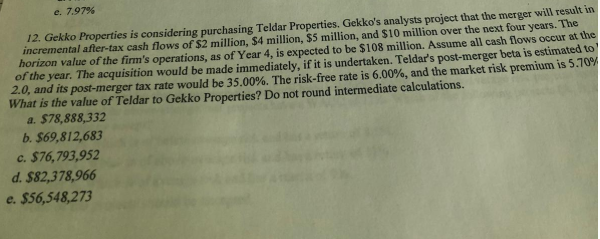

Question: e. 7.9796 12. Gekko Properties is considering purchasing Teldar Properties. Gekko's analysts project that the merger will result in incremental after-tax cash flows of $2

e. 7.9796 12. Gekko Properties is considering purchasing Teldar Properties. Gekko's analysts project that the merger will result in incremental after-tax cash flows of $2 million, $4 million, $5 million, and $10 million over the next four years. The horizon value of the firm's operations, as of Year 4, is expected to be $108 million. Assume all cash flows occur at the of the year. The acquisition would be made immediately, if it is undertaken. Teldar's post-merger beta is estimated to 2.0, and its post-merger tax rate would be 35.00%. The risk-free rate is 6.00%, and the market risk premium is 5.70% What is the value of Teldar to Gekko Properties? Do not round intermediate calculations. a. $78,888,332 b. $69,812,683 c. $76,793,952 d. $82,378,966 e. $56,548,273

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts