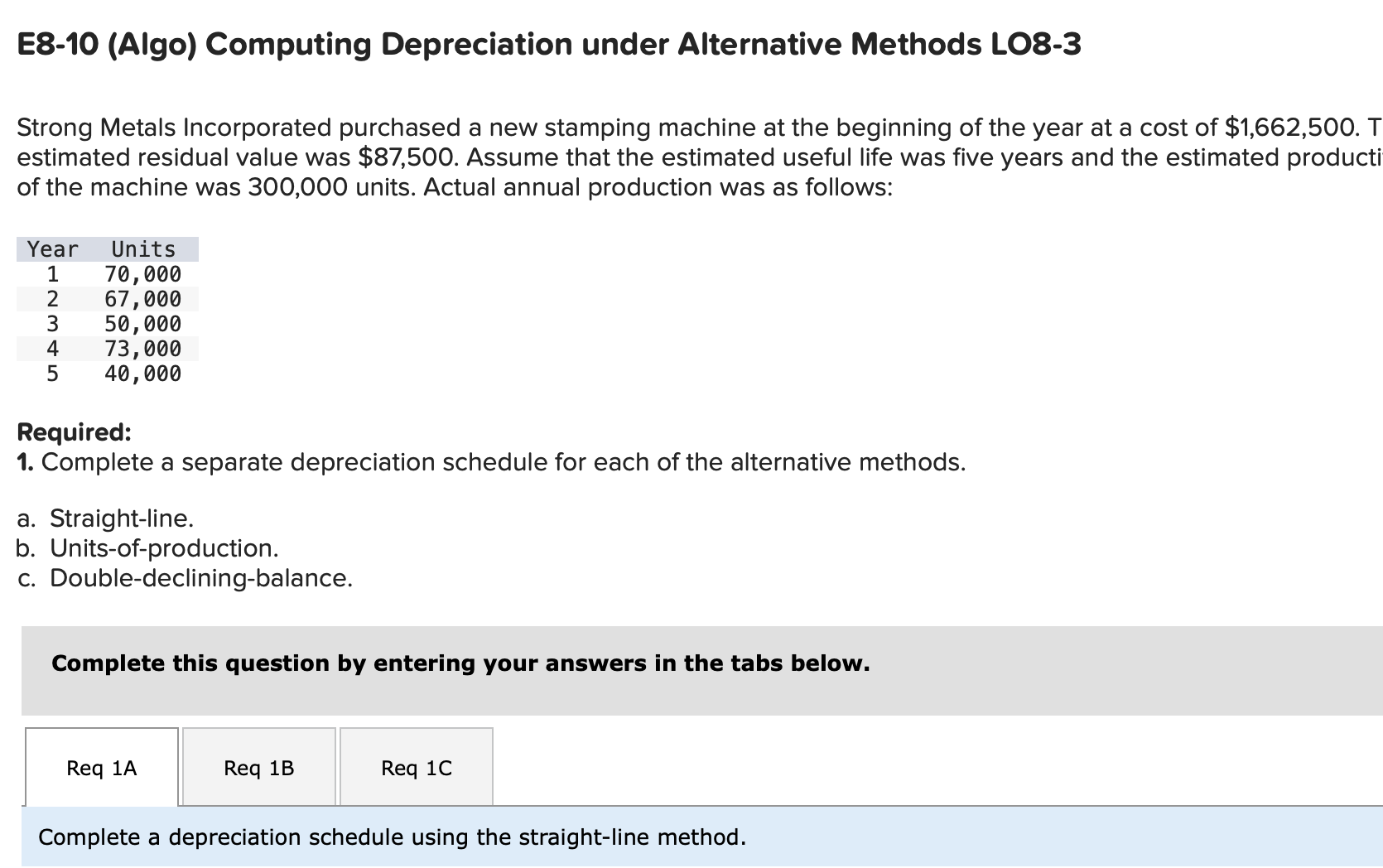

Question: E 8 - 1 0 ( Algo ) Computing Depreciation under Alternative Methods LO 8 - 3 Strong Metals Incorporated purchased a new stamping machine

EAlgo Computing Depreciation under Alternative Methods LO

Strong Metals Incorporated purchased a new stamping machine at the beginning of the year at a cost of $ T estimated residual value was $ Assume that the estimated useful life was five years and the estimated producti of the machine was units. Actual annual production was as follows:

Required:

Complete a separate depreciation schedule for each of the alternative methods.

a Straightline.

b Unitsofproduction.

c Doubledecliningbalance.

Complete this question by entering your answers in the tabs below.

Complete a depreciation schedule using the straightline method. Req A

Req B

Req C

Complete a depreciation schedule using the straightline method. Req A

Req B

Req C

Complete a depreciation schedule mathbfu : Assessment Tool iFrame luction method.

Note: Use two decimal places for the per unc output ractor.

begintabularclll

hline Year & begintabularc

Depreciation

Expense

endtabular & begintabularc

Accumulated

Depreciation

endtabular & begintabularc

Net

Book Value

endtabular

hline At acquisition & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline

endtabular Assessment Tool iFrame

Req A

Req B

Req C

Complete a depreciation schedule using the doubledecliningbalance method.

begintabularcccc

hline Year & begintabularc

Depreciation

Expense

endtabular & begintabularc

Accumulated

Depreciation

endtabular & begintabularc

Net

Book Value

endtabular

hline At acquisition & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock