Question: E AAF037 2 SEM1 20 21 test X + A 5 5 of 9 O File C:/Users/alexa/OneDrive/Desktop/AAF037-2_SEM1_20-21_%20testttttt.pdf + A Read aloud | Draw SECTION B

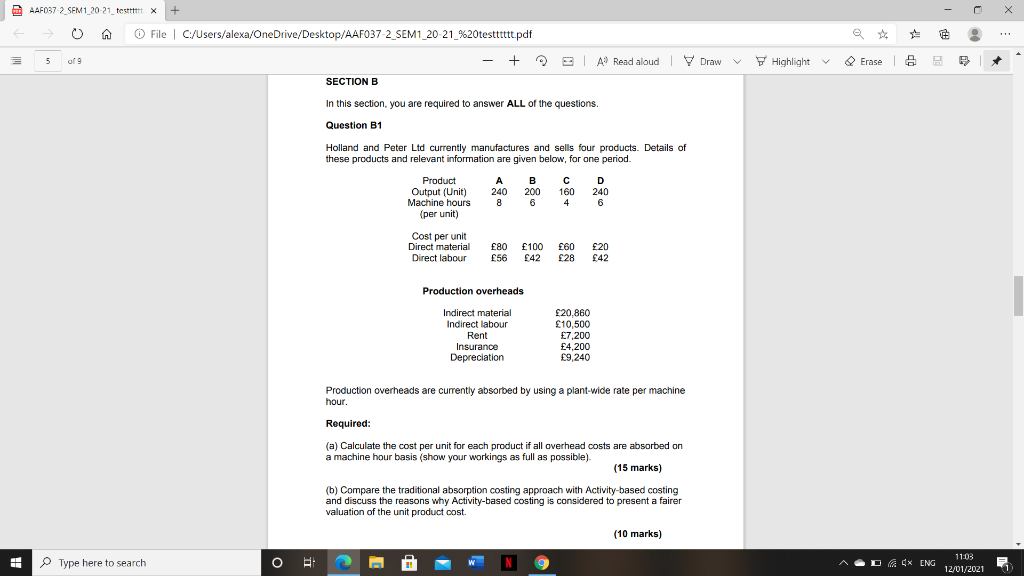

E AAF037 2 SEM1 20 21 test X + A 5 5 of 9 O File C:/Users/alexa/OneDrive/Desktop/AAF037-2_SEM1_20-21_%20testttttt.pdf + A Read aloud | Draw SECTION B Highlight Erase 8 E In this section, you are required to answer ALL of the questions. Question B1 Holland and Peter Ltd currently manufactures and sells four products. Details of these products and relevant information are given below, for one period Product Output (Unit) Machine hours (per unit) A 240 8 B 200 6 160 4 D 240 6 Cost per unit Direct material Direct labour 80 56 100 442 60 $28 20 642 Production overheads Indirect material Indirect labour Rent Insurance Depreciation 20,860 10,500 7,200 4,200 9,240 Production overheads are currently absorbed by using a plant-wide rate per machine - hour. Required: (a) Calculate the cost per unit for each product if all overhead costs are absorbed on a machine hour basis (show your workings as full as possible). (15 marks) (b) Compare the traditional absorption costing approach with Activity-based costing and discuss the reasons why Activity-based costing is considered to present a fairer valuation of the unit product cost. . (10 marks) Type here to search OBI Dax ENG 11:03 12/01/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts