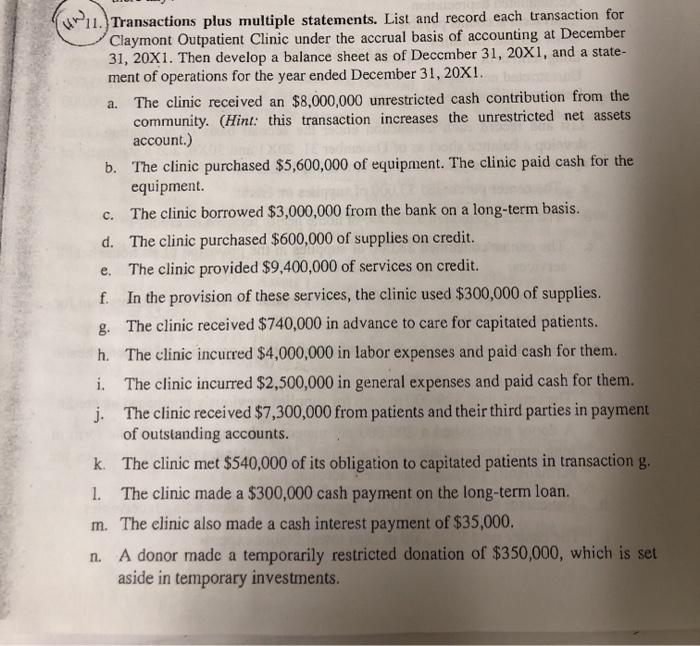

Question: e. Am 1. Transactions plus multiple statements. List and record each transaction for Claymont Outpatient Clinic under the accrual basis of accounting at December 31,

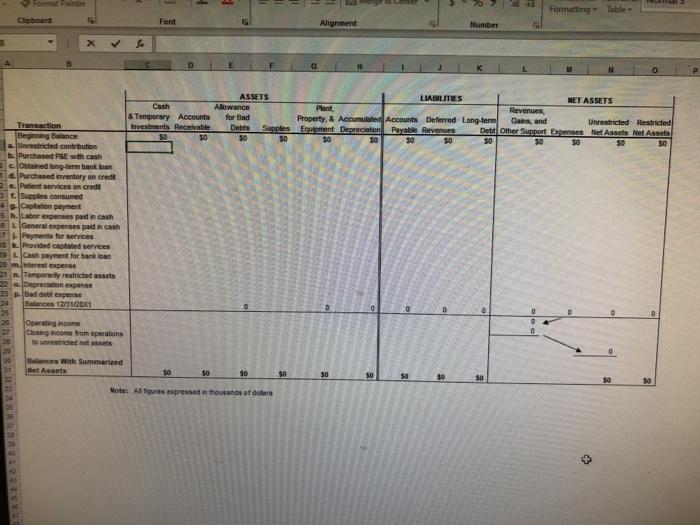

e. Am 1. Transactions plus multiple statements. List and record each transaction for Claymont Outpatient Clinic under the accrual basis of accounting at December 31, 20X1. Then develop a balance sheet as of December 31, 20X1, and a state- ment of operations for the year ended December 31, 20X1. a. The clinic received an $8,000,000 unrestricted cash contribution from the community. (Hint: this transaction increases the unrestricted net assets account.) b. The clinic purchased $5,600,000 of equipment. The clinic paid cash for the equipment. c. The clinic borrowed $3,000,000 from the bank on a long-term basis. d. The clinic purchased $600,000 of supplies on credit. The clinic provided $9,400,000 of services on credit. f. In the provision of these services, the clinic used $300,000 of supplies. g. The clinic received $740,000 in advance to care for capitated patients. h. The clinic incurred $4,000,000 in labor expenses and paid cash for them. i. The clinic incurred $2,500,000 in general expenses and paid cash for them. j. The clinic received $7,300,000 from patients and their third parties in payment of outstanding accounts. k. The clinic met $540,000 of its obligation to capitated patients in transaction g. 1. The clinic made a $300,000 cash payment on the long-term loan. m. The clinic also made a cash interest payment of $35,000. n. A donor made a temporarily restricted donation of $350,000, which is set aside in temporary investments. Formatting - Table Clipboard Font Alignment Number 3 ASSETS LIABILITIES NET ASSETS Cash Allowance Plant Revenues & Temporary Accounts for Bad Property & Accumulated Accounts Deferred Long-term Gains, and Unrestricted Restricted Investments Receivable Debts Soles Ecument Depreciation Payable Revenues Debt Other Support Expenses Net Assets Net Assets 50 SO 50 $0 50 50 50 50 $0 50 50 Transaction Beginning Bence restricted contrbution Purchased PE woh cash contained long-term bank loan a. Purchased inventory on credit e. Patent services on credt Supplies consumed 4 Captation payment SM.Lr expenses paid in cash General expenses paid in cash Pays for services 13. Provided called services 29 L Cash payment for bank loan 30 m.interest expense 21. Temporarily restricted assets 22 Depreciation eine 23 sett expense Balances 2/120X1 DO Opening income Closing come from operations to restricted to set Balance With Summarized Net Asset 50 $0 50 50 50 so $0 Motel Alpures expressed in thousands of dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts