Question: e and g Yanaga Class time NPV (50 points) Your company is undertaking a new project. Equipment was purchased 2 years ago for $350,000 depreciated

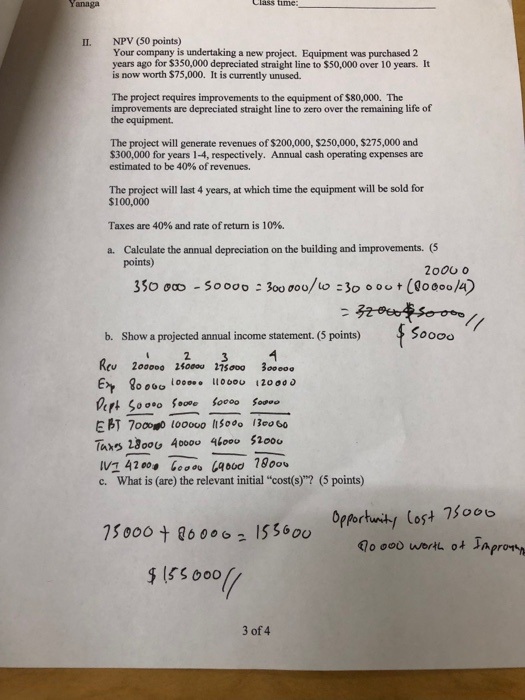

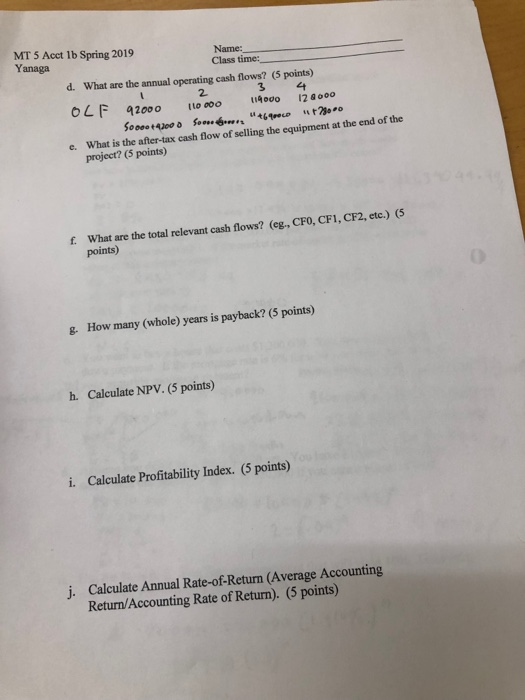

Yanaga Class time NPV (50 points) Your company is undertaking a new project. Equipment was purchased 2 years ago for $350,000 depreciated straight line to $50,000 over 10 years. It is now worth $75,000. It is currently unused I. The project requires improvements to the equipment of $80,000. The improvements are depreciated straight line to zero over the remaining life of the equipment. The project will generate revenues of $200,000, $250,000, $275,000 and $300,000 for years 1-4, respectively. Annual cash operating expenses are estimated to be 40% of revenues. The project will last 4 years, at which time the equipment will be sold for $100,000 Taxes are 40 % and rate of return is 10 % . Calculate the annual depreciation on the building and improvements. (5 points) a. 350 oco-Soo00 300 000/o 30 000t Cloo00/4) Soo00 Show a projected annual income statement. (5 points) b. 2. Reu 200000 240000 275o00 3 E Roors looe. 10oou 120000 Sooo EBT 7o0o tooooo iso0o 13eo60 Tars 2800 4000u 4boou $2000 c. What is (are) the relevant initial "cost(s)"? (5 points) Opportunity Cost 75oo0 Japron 75000 t 80006 155600 70 000 wortL ot 3 of 4 MT 5 Acct lb Spring 2019 Yanaga Name: Class time: d. What are the annual operating cash flows? (5 points) 4 12 Go00 3 u4000 2. OLF 92000 (to 000 Soo014200 "6LD So What is the after-tax cash flow of selling the equipment at the end of the project? (5 points) e. 944.39 f What are the total relevant cash flows? (eg., CF0, CF1, CF2, etc.) (5 points) How many (whole) years is payback? (5 points) g h. Calculate NPV. (5 points) i. Calculate Profitability Index. (5 points) Calculate Annual Rate-of-Returm (Average Accounting j. Return/Accounting Rate of Return). (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts