Question: E ANSWER THE FOLLOWING QUESTION ON EX PLEASE USE EXCEL TO SHOW CALCULATIONS PROBLEMS 1,2,6,7 PROBLEMS the discount yield, bond equivalent yield, and effec. ive

E ANSWER THE FOLLOWING QUESTION ON EX PLEASE USE EXCEL TO SHOW CALCULATIONS PROBLEMS 1,2,6,7

PLEASE USE EXCEL TO SHOW CALCULATIONS PROBLEMS 1,2,6,7

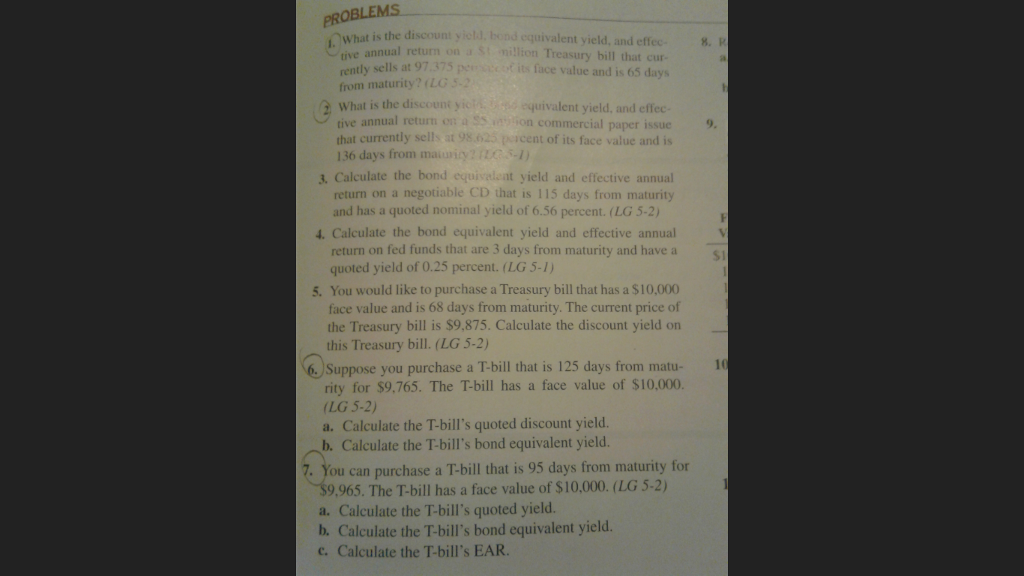

PROBLEMS the discount yield, bond equivalent yield, and effec. ive annual return on a St million Treasury bill that cur ly sells at 97 375p e fits face value and is 65 days from maturity?LG 5.2 2 What is the discount yio equivalent yield, and effec tive annual return on a Sanion com commercial paper issue9. that currently sells at 98.625 percent of its face value and is 136 days from mawity251) 3. Calculate the bond equiveleat yield and effective annual return on a negotiable CD that is 115 days from maturity and has a quoted nominal yield of 6.56 percent. (LG 5-2) 4. Calculate the bond equivalent yield and effective annual return on fed funds that are 3 days from maturity and have a s quoted yield of 0.25 percent. (LG 5-1) S1 5. You would like to purchase a Treasury bill that has a $10,000 face value and is 68 days from maturity. The current price of the Treasury bill is $9,875. Calculate the discount yield orn this Treasury bill. (LG 5-2) 6.Suppose you purchase a T-bill that is 125 days from matu-1 rity for $9,765. The T-bill has a face value of $10,000. (LG 5-2) a. Calculate the T-bill's quoted discount yield. b. Calculate the T-bill's bond equivalent yield. 7. You can purchase a T-bill that is 95 days from maturity for $9,965. The T-bill has a face value of S10,000. (LG 5-2) a. Calculate the T-bill's quoted yield. b. Calculate the T-bill's bond equivalent yield. c. Calculate the T-bill's EAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts