Question: e appendix b appendix d Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $2,000 bond) Exercise price: $27 Maturity date:

e

appendix b

appendix d

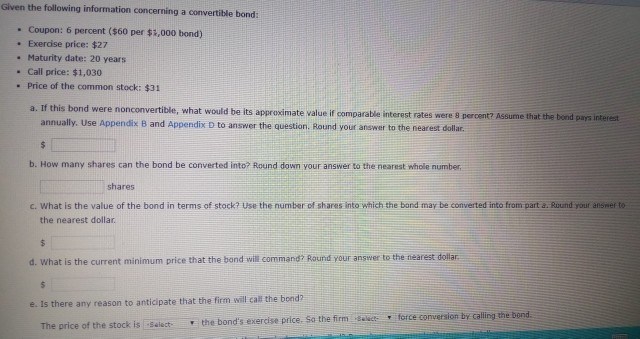

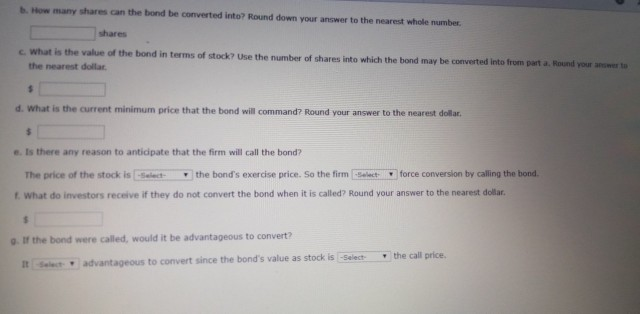

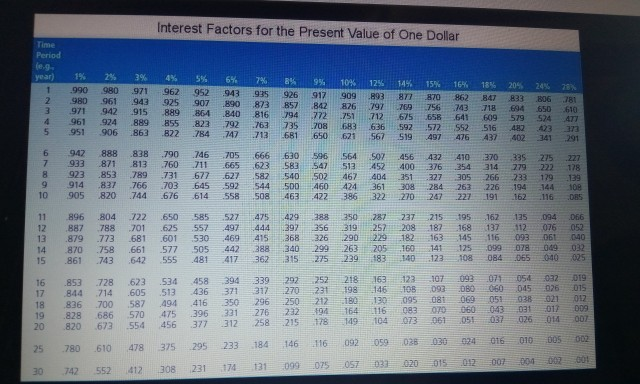

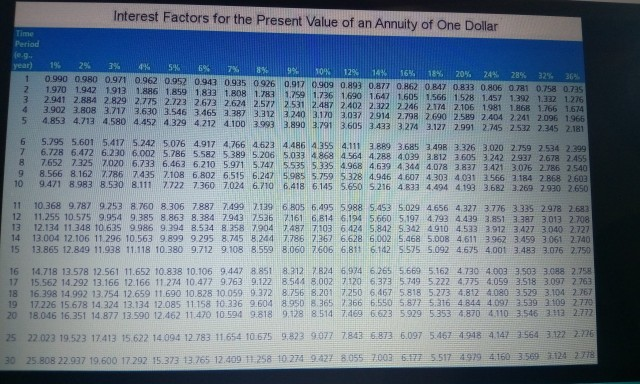

Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $2,000 bond) Exercise price: $27 Maturity date: 20 years Call price: $1,030 Price of the common stock: $31 a. If this bond were nonconvertible, what would be its approximate value if comparable interest rates were 8 percent Assume that the bond parintere annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar b. How many shares can the bond be converted into Round down your answer to the nearest whole number shares c. What is the value of the bond in terms of stock? Use the number of shares into which the band may be converted into from part a. Round your answer to the nearest dollar d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar e. Is there any reason to anticipate that the firm will call the bond the bond's exercise price. So the firm select The price of the stock is Select force conversion by calling the bond. 5. How many shares can the bond be converted into Round down your answer to the nearest whole number shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a. Round you the nearest dollar to d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar . Is there any reason to anticipate that the firm will call the bond? The price of the stock is Select the bond's exercise price. So the firm -Select a force conversion by calling the bond. 1. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar, . If the bond were called, would it be advantageous to convert? the call price. It Select advantageous to convert since the bond's value as stock is Select Interest Factors for the Present Value of One Dollar Period 30 %, 5,749 1 74% 15% 161 % 2024% 1996 BD 16:02943995 91783980 HLB/E4106B1 7 D951941 4170913 BE : 276 759 : JIBR650 199479899 - B108|| 4 5 T1265 E58 41 E9 5544 1 24 ,TF11350 () G6 57 53 56423333 5 %! OF Bhd By B441_T1681650x 759 46 47 1410 50: 0388 838466 1931871812750 TT15: 630 96 564 7 422 AD1717 SB35] 42 400 122TB 23BS5 TFT : : 540 | abd 105 256 11 10 14 25035 44 50 40 44 18 BA ,EP 905820744676614.558.508 -- -463|422_ 2007 191 13 IECES 11896 804 22 650 55 5. 47% 429 1 9 :16:15094 LED. BB: HBDI 6.5 557 : 444 1208_187 68 1171207 15 89 73 EB16001 469 415 (368 6 22 : 45-16 -- BIG ABD5BETA? 38 3D- 1263-205 -160-1411125 .099 078 -3049-3032 15 18613 542 555 481 17 18: 13 16853 28 623 534 458 -30 30 12 15: 197537 Bell 1- 605 436 37 32 2 4 000ETF Jun36 DIS 18836700 587494 416 350 0 JB0100 HA0 D5103021-07- - 196 1992856 50 ]- 29 0 0 01: 11 DES- 20 820673 54 456 37 32 58 21 0 0 073 16- 07-175014-06 25780 610 478 375205 233 184 46 116-02 DES-038 024 Elbolt_p05 02 | 2 742 52 308 14 1 2009 _075 17 03- 20 0 012 0 360 004_137 56 Interest Factors for the Present Value of an Annuity of One Dollar Time Period year 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 19 10% 12% 16% 18% 20% 24% 28% 32% 36% 0990 0.980 0.971 0.962 0.952 0.94 09350 926 0.917 0.909 0.993 0877 862 0.847 0813 0 806 0.781 0.750 0.735 1970 1.942 1913 1986 1.859 1823 B 1. 1.259 1.736 1.690 1647 1605 1.566 1.528 1.457 1.392 1.12 1.276 2041 2.884 2829 2.775 2.723 2673 2624 2.572 2531 2.457 2402 2 2 2 246 2174 2106 1981 1868 1766 1674 3902 BOB 3.717 3630 3546 3.465 3.27 3.2122240 31703037 2 914 2.79 2690 2589 2.404 2 241 2.096 1965 4853 4.71 4.580 4.452 4 329 42124 100 39933.890 3.791 3.605 3433 3214 3.127 2.991 2245 2512 2.345 2181 6 7 B 9 10 5.795 5.601 5.417 5242 5076 4917 4.766 4623 4 486 4.355 4.111 3 BRO 3.685 3.498 3376 3070 2.759 2.5342299 6.728 6.472 6230 6.002 5.786 5.582 5 389 5 206 5033 4868 4564 4.2 40393 812 3 6053242 2937 2.678 2.455 7652 7325 7020 6.733 6.463 6.210 5.971 5.747 5535 5335 4.968 4.639 4 344 4.078 3837 3.421 3076 2.786 2.540 8.566 8.16227867435 2108 6.802 6 515 6247 595 5.759 51328 4.946 4 607 4.30340313566 184 7.868 2603 9.471 8.983 8.530 8.111 2.722 7.360 7.024 6.710 6.418 6.145 5.650 S 216 4.833 4.494 4 193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.78792528760 8.306 7.887 2499 2119 60 6.495 5198 5.453 5.029 4.656 4227 3 776 3 335 29782583 11.255 10.57599549 385 8863 8.384 7943 75367.1616.814 6.194 5.660 5.197 4.793 4.419851 27 30132 708 12 134 11 348 10.635 996 994 8.5348258 79047497 7103 6.424 5 842 S342 491045737912342730402727 13 004 12 106 11 296 10.563 98999295 8.745 824177867367 6.628 6 002 5.468 50084 511 3962 3459 30612740 13.865 12.849 11.938 11.118 10.3809712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4675 4.001 3.483 3076 2.750 16 14.718 13 578 12 561 11.652 10.838 10.105 9.447 8851 8.3127 824 6.9746265 5669 5.162 473040033 503 3088275 1 | 149 13 66 7 106 11 24 10 4 9 753 912 4 002 170 69 140 5 5 4 0 3518 309 353 18 16 29 14 992 12.754 12.659 11 690 10.328 10 059 9.272 8.756 3.2017.250 6.467 5.818 5.2734.812 408035293.104 2767 19 17 226 15 678 14 324 12 134 12.085 11 158 10.336 9604 8950 8.3652356 6.550 5.87753164 844 4 097 5293 109 2 770 2018.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11654 10 675 9.823 90777843 6.873 6.097 5.467 1918 4.147 3.564 3.122 2.776 0 25 808 22.937 19.600 17.292 15 373 13 765 12.409 11.258 10 2709.422 8055700269775517 4979 4.160 3.569 2124 2178 Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $2,000 bond) Exercise price: $27 Maturity date: 20 years Call price: $1,030 Price of the common stock: $31 a. If this bond were nonconvertible, what would be its approximate value if comparable interest rates were 8 percent Assume that the bond parintere annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar b. How many shares can the bond be converted into Round down your answer to the nearest whole number shares c. What is the value of the bond in terms of stock? Use the number of shares into which the band may be converted into from part a. Round your answer to the nearest dollar d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar e. Is there any reason to anticipate that the firm will call the bond the bond's exercise price. So the firm select The price of the stock is Select force conversion by calling the bond. 5. How many shares can the bond be converted into Round down your answer to the nearest whole number shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a. Round you the nearest dollar to d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar . Is there any reason to anticipate that the firm will call the bond? The price of the stock is Select the bond's exercise price. So the firm -Select a force conversion by calling the bond. 1. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar, . If the bond were called, would it be advantageous to convert? the call price. It Select advantageous to convert since the bond's value as stock is Select Interest Factors for the Present Value of One Dollar Period 30 %, 5,749 1 74% 15% 161 % 2024% 1996 BD 16:02943995 91783980 HLB/E4106B1 7 D951941 4170913 BE : 276 759 : JIBR650 199479899 - B108|| 4 5 T1265 E58 41 E9 5544 1 24 ,TF11350 () G6 57 53 56423333 5 %! OF Bhd By B441_T1681650x 759 46 47 1410 50: 0388 838466 1931871812750 TT15: 630 96 564 7 422 AD1717 SB35] 42 400 122TB 23BS5 TFT : : 540 | abd 105 256 11 10 14 25035 44 50 40 44 18 BA ,EP 905820744676614.558.508 -- -463|422_ 2007 191 13 IECES 11896 804 22 650 55 5. 47% 429 1 9 :16:15094 LED. BB: HBDI 6.5 557 : 444 1208_187 68 1171207 15 89 73 EB16001 469 415 (368 6 22 : 45-16 -- BIG ABD5BETA? 38 3D- 1263-205 -160-1411125 .099 078 -3049-3032 15 18613 542 555 481 17 18: 13 16853 28 623 534 458 -30 30 12 15: 197537 Bell 1- 605 436 37 32 2 4 000ETF Jun36 DIS 18836700 587494 416 350 0 JB0100 HA0 D5103021-07- - 196 1992856 50 ]- 29 0 0 01: 11 DES- 20 820673 54 456 37 32 58 21 0 0 073 16- 07-175014-06 25780 610 478 375205 233 184 46 116-02 DES-038 024 Elbolt_p05 02 | 2 742 52 308 14 1 2009 _075 17 03- 20 0 012 0 360 004_137 56 Interest Factors for the Present Value of an Annuity of One Dollar Time Period year 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 19 10% 12% 16% 18% 20% 24% 28% 32% 36% 0990 0.980 0.971 0.962 0.952 0.94 09350 926 0.917 0.909 0.993 0877 862 0.847 0813 0 806 0.781 0.750 0.735 1970 1.942 1913 1986 1.859 1823 B 1. 1.259 1.736 1.690 1647 1605 1.566 1.528 1.457 1.392 1.12 1.276 2041 2.884 2829 2.775 2.723 2673 2624 2.572 2531 2.457 2402 2 2 2 246 2174 2106 1981 1868 1766 1674 3902 BOB 3.717 3630 3546 3.465 3.27 3.2122240 31703037 2 914 2.79 2690 2589 2.404 2 241 2.096 1965 4853 4.71 4.580 4.452 4 329 42124 100 39933.890 3.791 3.605 3433 3214 3.127 2.991 2245 2512 2.345 2181 6 7 B 9 10 5.795 5.601 5.417 5242 5076 4917 4.766 4623 4 486 4.355 4.111 3 BRO 3.685 3.498 3376 3070 2.759 2.5342299 6.728 6.472 6230 6.002 5.786 5.582 5 389 5 206 5033 4868 4564 4.2 40393 812 3 6053242 2937 2.678 2.455 7652 7325 7020 6.733 6.463 6.210 5.971 5.747 5535 5335 4.968 4.639 4 344 4.078 3837 3.421 3076 2.786 2.540 8.566 8.16227867435 2108 6.802 6 515 6247 595 5.759 51328 4.946 4 607 4.30340313566 184 7.868 2603 9.471 8.983 8.530 8.111 2.722 7.360 7.024 6.710 6.418 6.145 5.650 S 216 4.833 4.494 4 193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.78792528760 8.306 7.887 2499 2119 60 6.495 5198 5.453 5.029 4.656 4227 3 776 3 335 29782583 11.255 10.57599549 385 8863 8.384 7943 75367.1616.814 6.194 5.660 5.197 4.793 4.419851 27 30132 708 12 134 11 348 10.635 996 994 8.5348258 79047497 7103 6.424 5 842 S342 491045737912342730402727 13 004 12 106 11 296 10.563 98999295 8.745 824177867367 6.628 6 002 5.468 50084 511 3962 3459 30612740 13.865 12.849 11.938 11.118 10.3809712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4675 4.001 3.483 3076 2.750 16 14.718 13 578 12 561 11.652 10.838 10.105 9.447 8851 8.3127 824 6.9746265 5669 5.162 473040033 503 3088275 1 | 149 13 66 7 106 11 24 10 4 9 753 912 4 002 170 69 140 5 5 4 0 3518 309 353 18 16 29 14 992 12.754 12.659 11 690 10.328 10 059 9.272 8.756 3.2017.250 6.467 5.818 5.2734.812 408035293.104 2767 19 17 226 15 678 14 324 12 134 12.085 11 158 10.336 9604 8950 8.3652356 6.550 5.87753164 844 4 097 5293 109 2 770 2018.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11654 10 675 9.823 90777843 6.873 6.097 5.467 1918 4.147 3.564 3.122 2.776 0 25 808 22.937 19.600 17.292 15 373 13 765 12.409 11.258 10 2709.422 8055700269775517 4979 4.160 3.569 2124 2178

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts