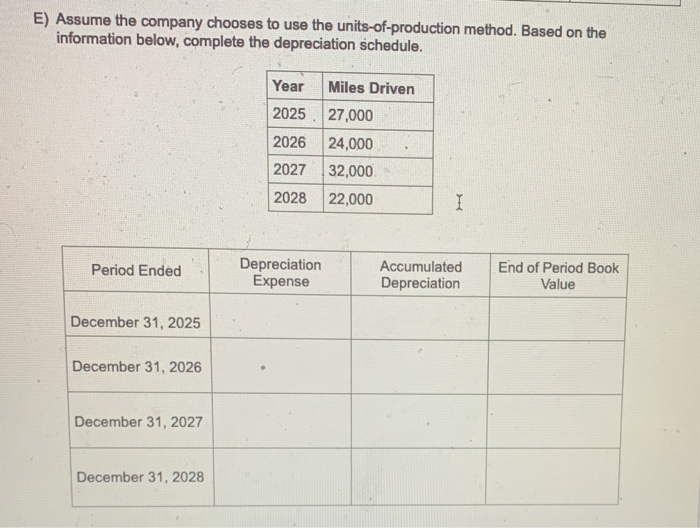

Question: E) Assume the company chooses to use the units-of-production method. Based on the information below, complete the depreciation schedule. Year Miles Driven 2025 27,000 2026

E) Assume the company chooses to use the units-of-production method. Based on the information below, complete the depreciation schedule. Year Miles Driven 2025 27,000 2026 24,000 2027 32,000 2028 22,000 I Period Ended Depreciation Expense Accumulated Depreciation End of Period Book Value December 31, 2025 December 31, 2026 December 31, 2027 December 31, 2028 E) Assume the company chooses to use the units-of-production method. Based on the information below, complete the depreciation schedule. Year Miles Driven 2025 27,000 2026 24,000 2027 32,000 2028 22,000 I Period Ended Depreciation Expense Accumulated Depreciation End of Period Book Value December 31, 2025 December 31, 2026 December 31, 2027 December 31, 2028

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts