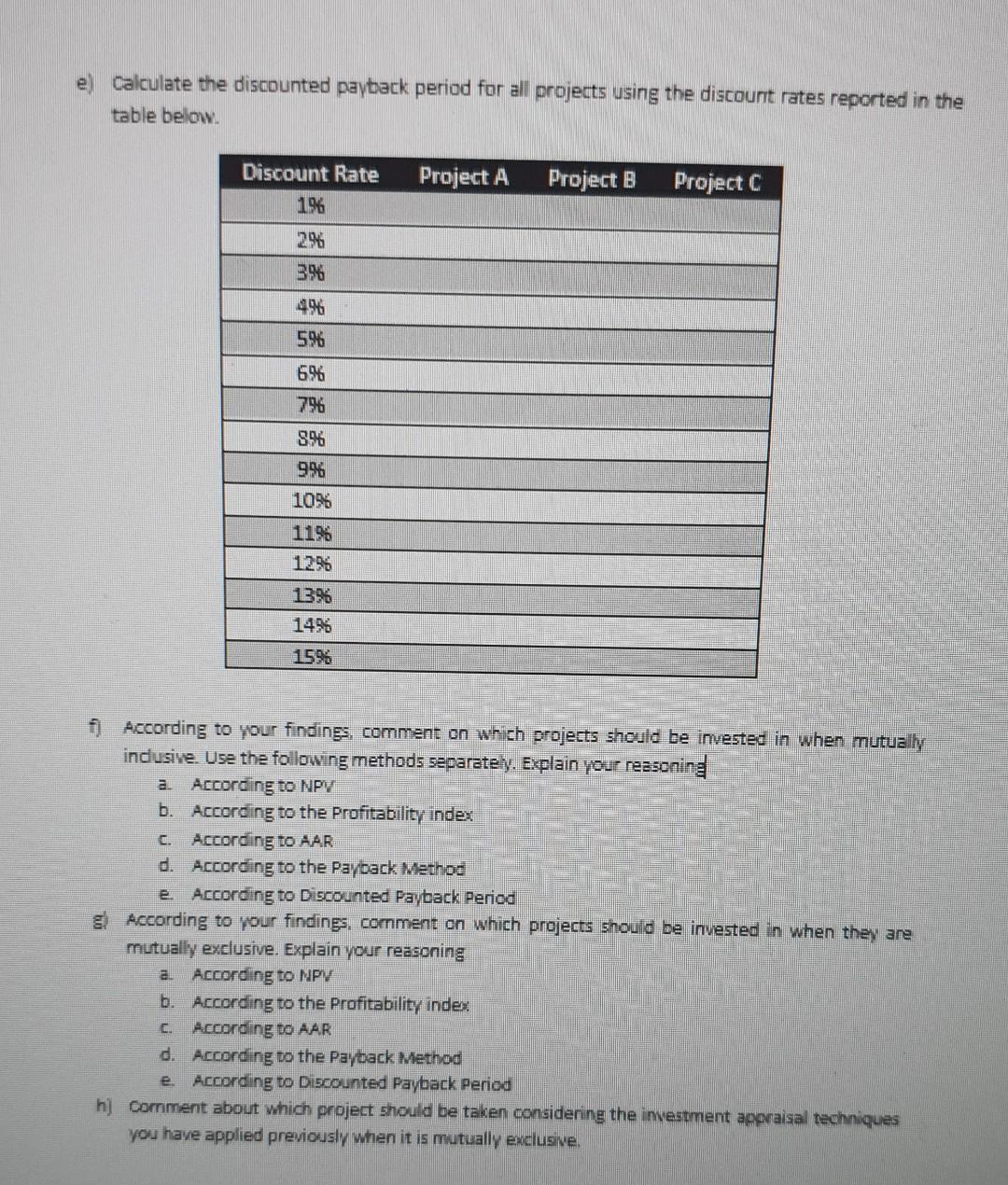

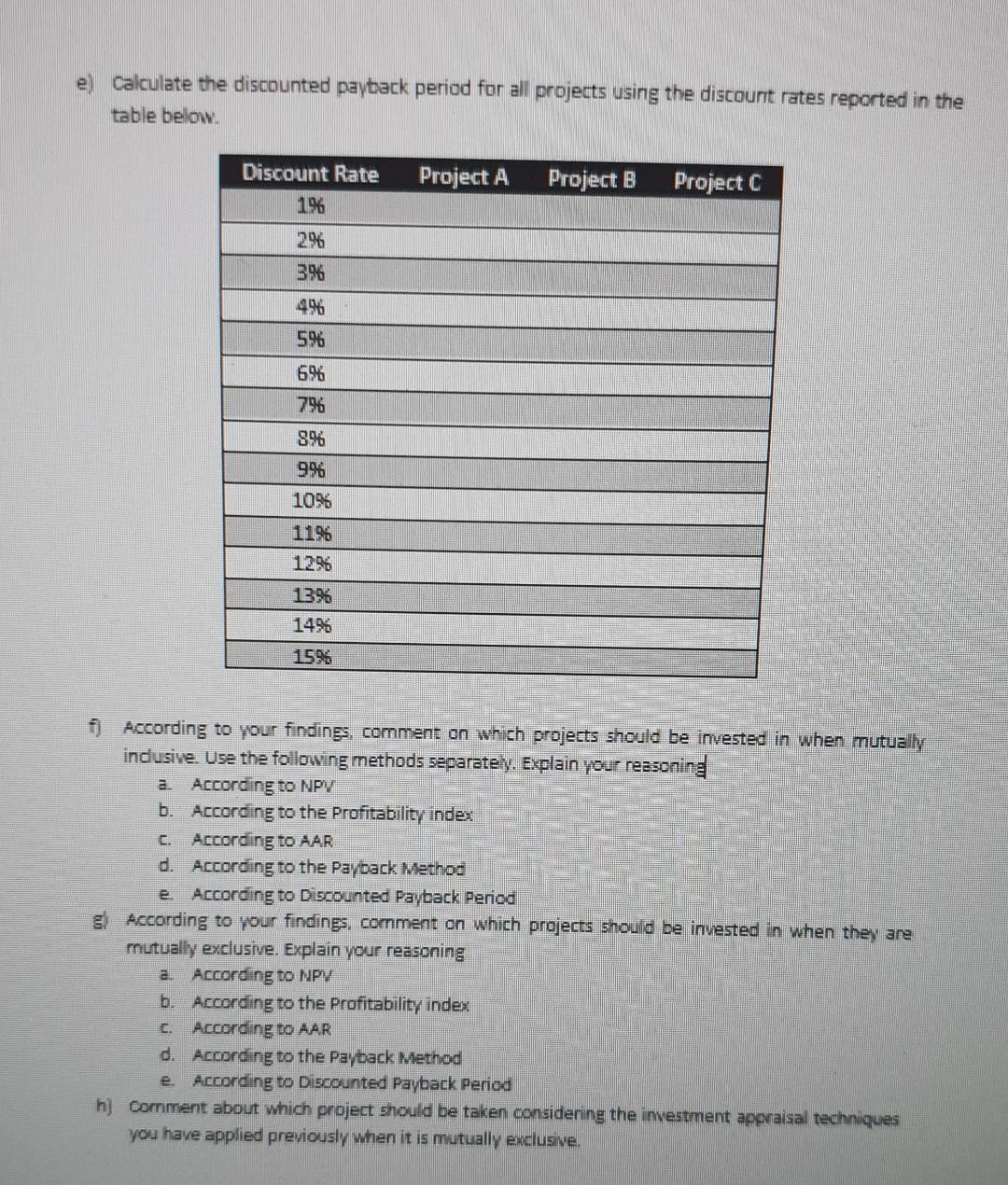

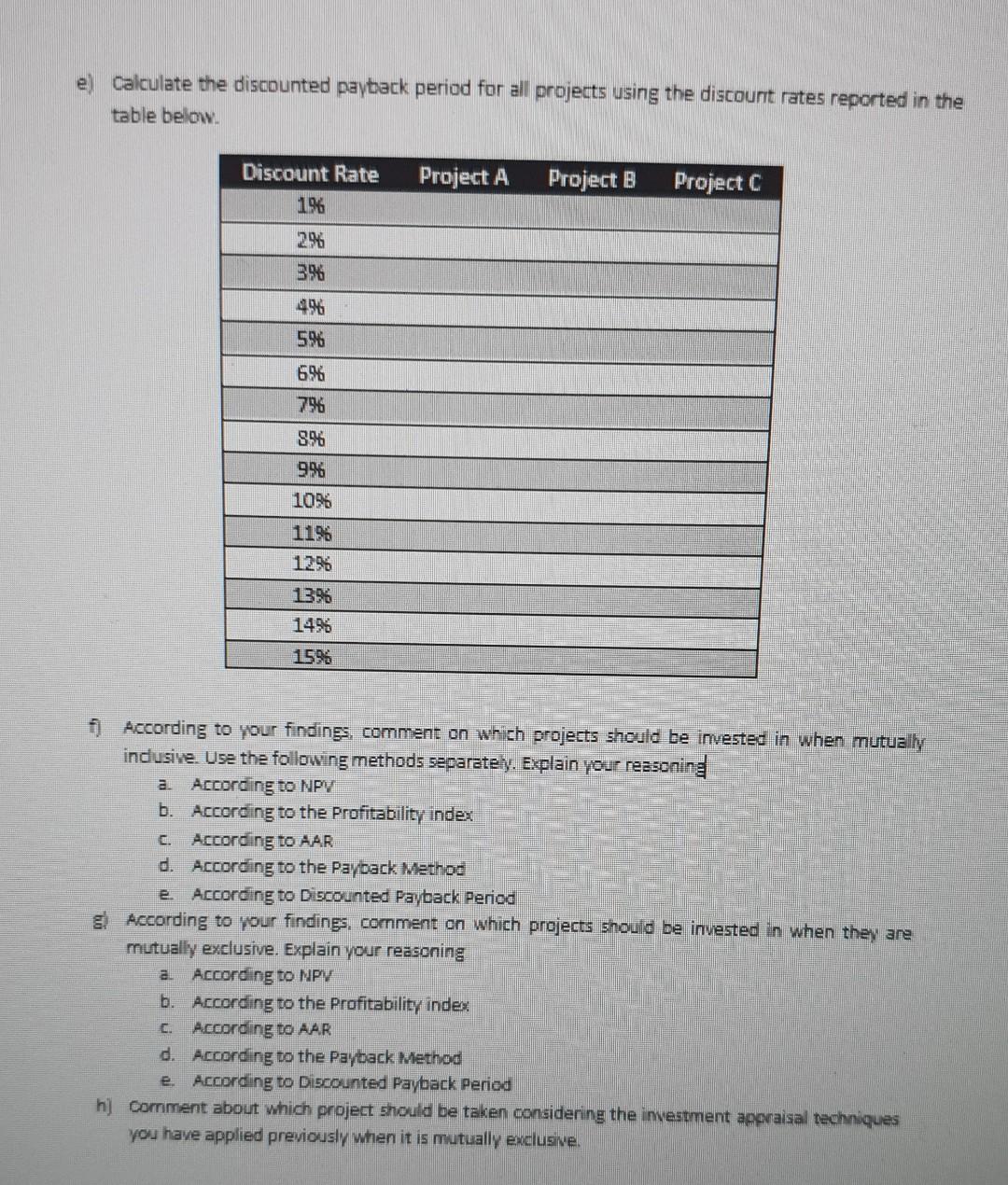

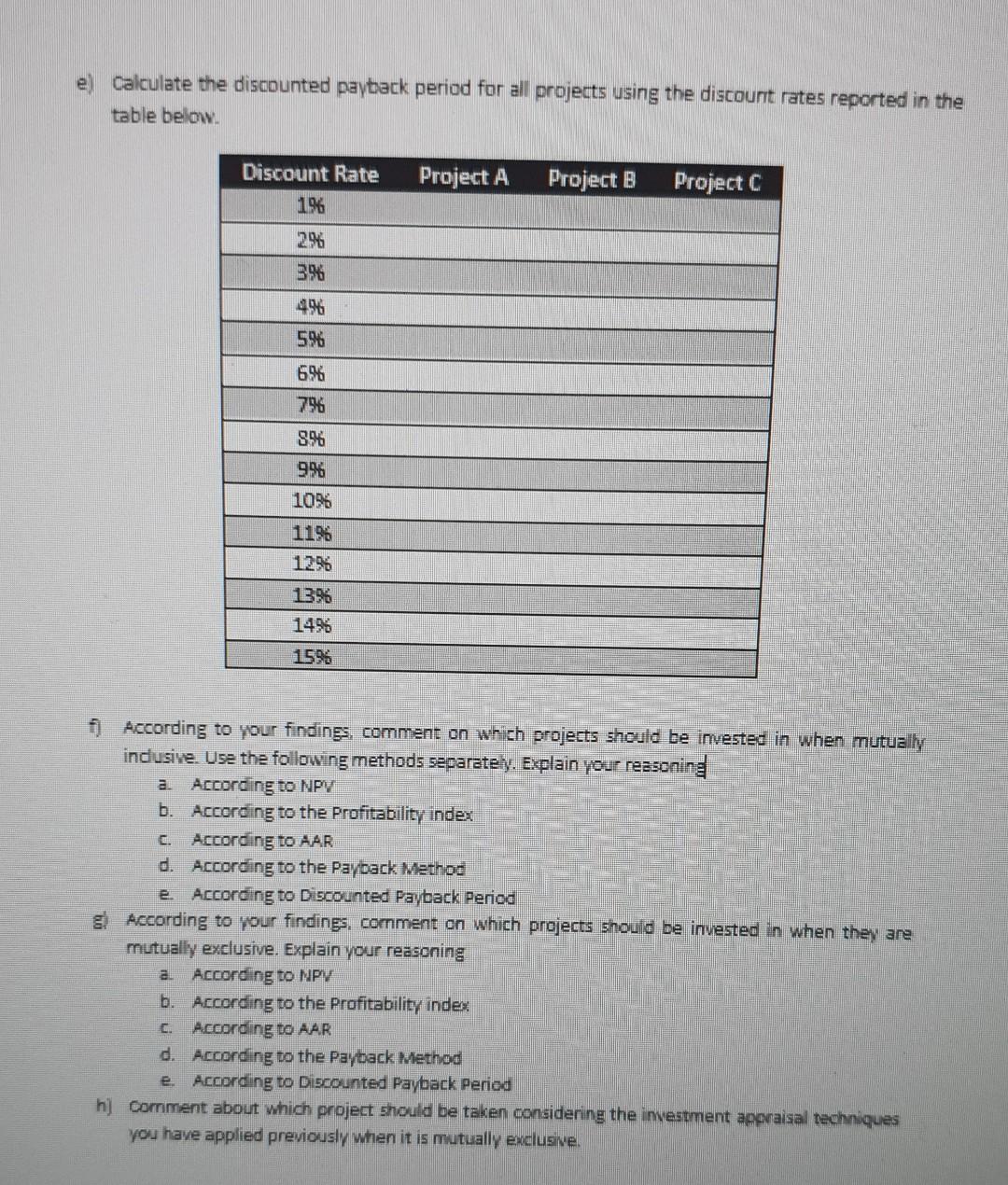

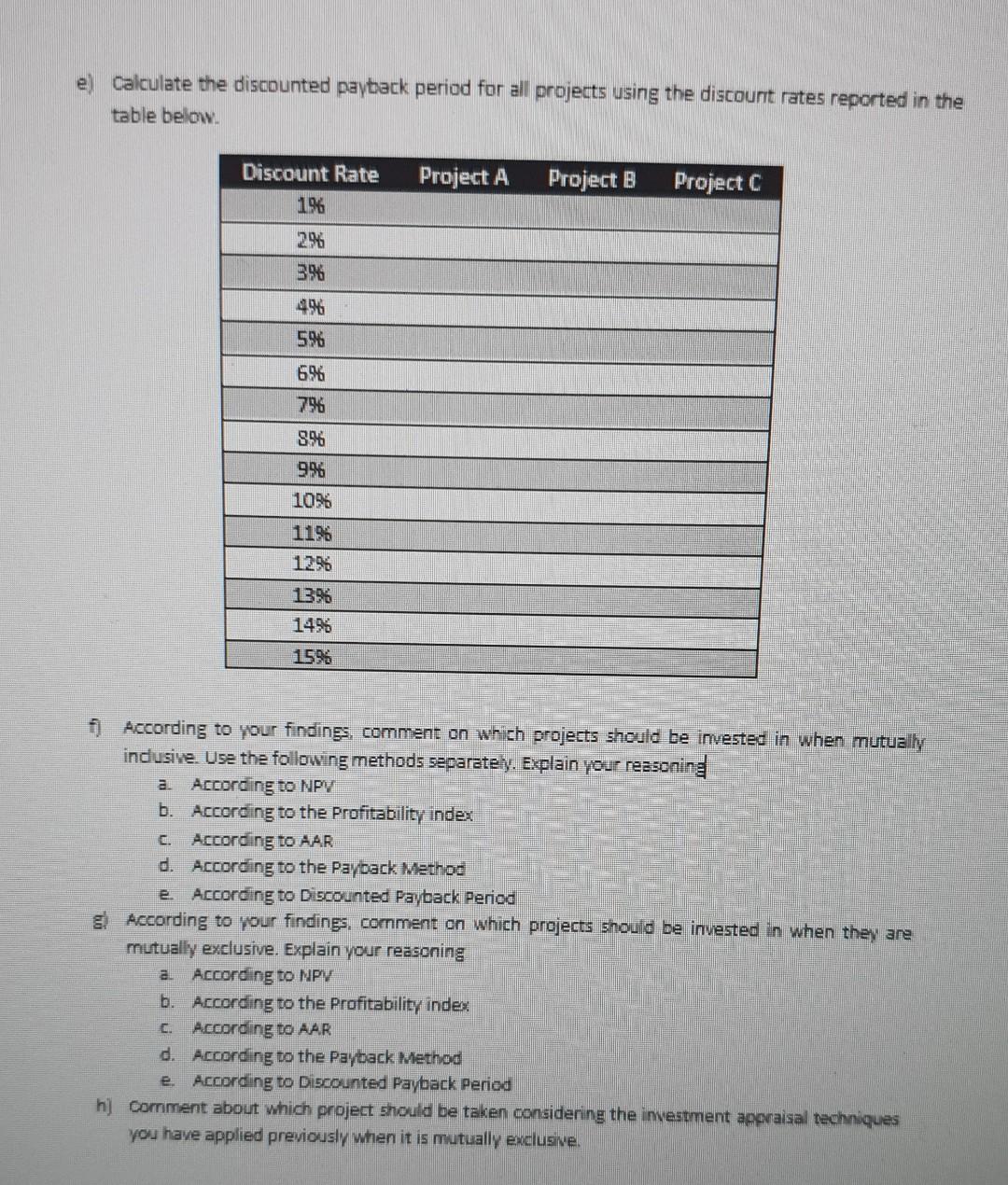

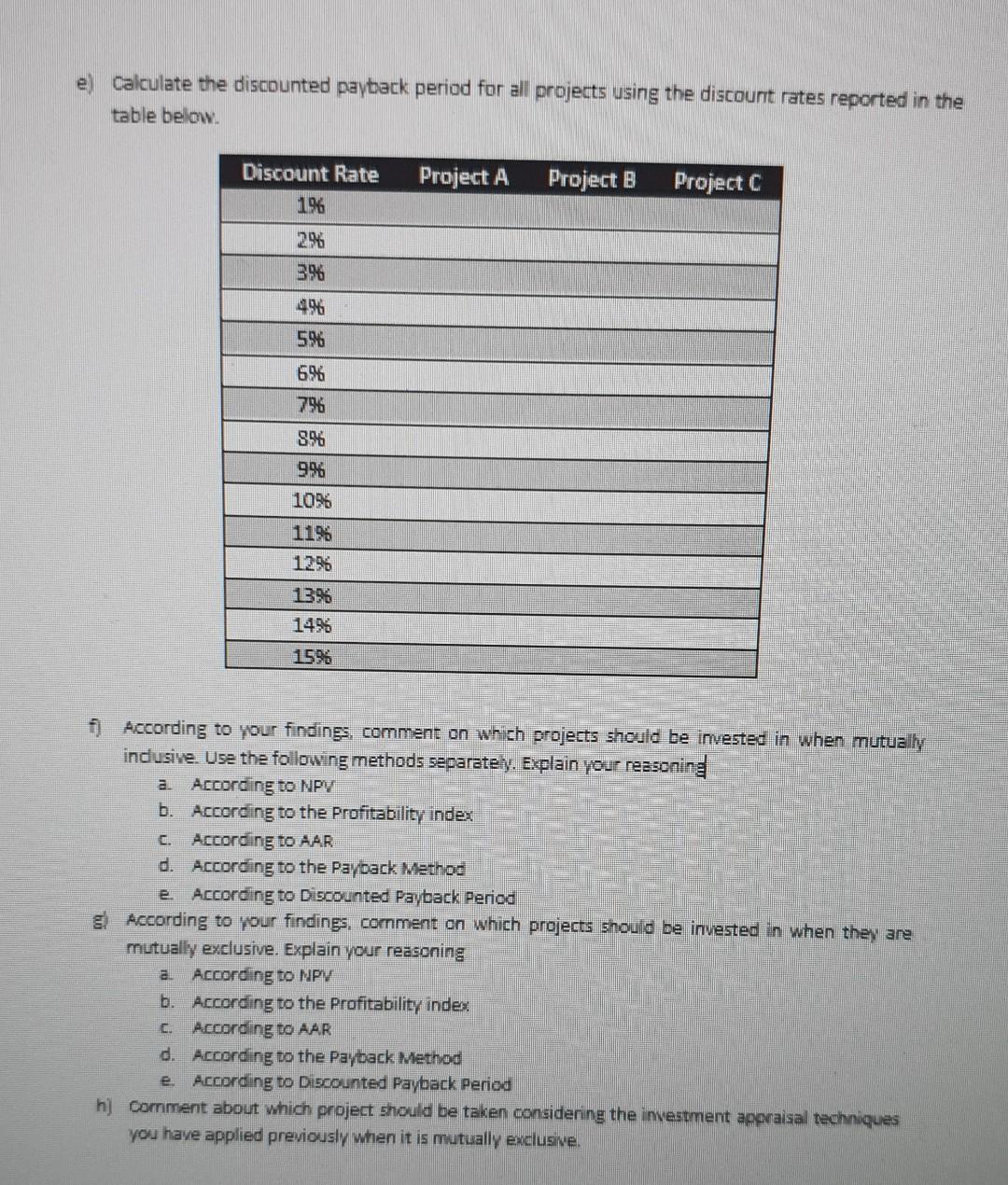

Question: e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project

e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive. e) Calculate the discounted payback period for all projects using the discount rates reported in the table below. Discount Rate Project A Project B Project C 196 2.96 3% 496 5% 6% 796 8.96 9% 10% 11% 12% 13% 14% 1.5% f) According to your findings, comment on which projects should be invested in when mutually inclusive. Use the following methods separately. Explain your reasoning a. According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period According to your findings, comment on which projects should be invested in when they are mutually exclusive. Explain your reasoning a According to NPV b. According to the Profitability index c. According to AAR d. According to the Payback Method e. According to Discounted Payback Period h) Comment about which project should be taken considering the investment appraisal techniques you have applied previously when it is mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts