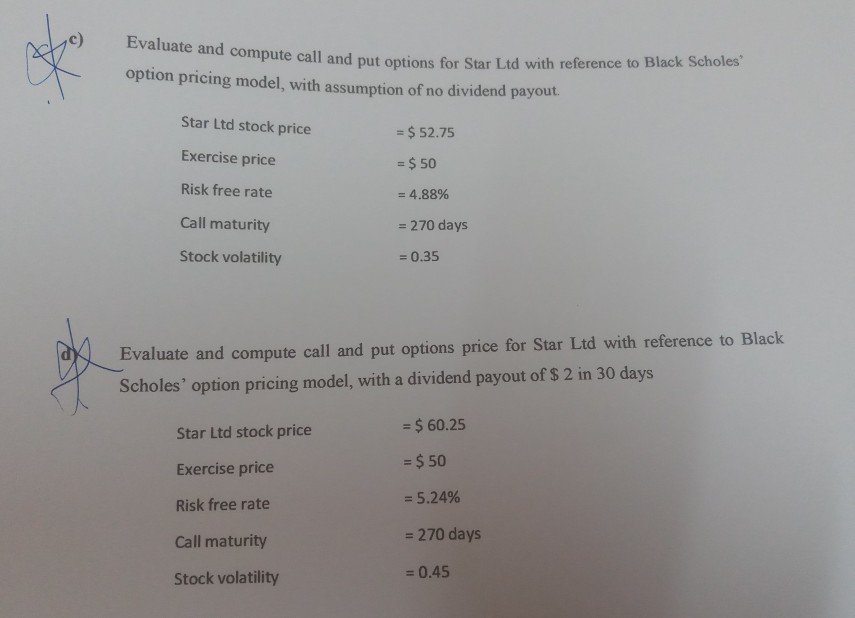

Question: e call and put options for Star Ltd with reference to Black Scholes option pricing model, with assumption of no dividend payout Star Ltd stock

e call and put options for Star Ltd with reference to Black Scholes option pricing model, with assumption of no dividend payout Star Ltd stock price Exercise price Risk free rate Call maturity Stock volatility $ 52.75 = 4.88% = 270 days - 0.35 Evaluate and compute call and put options price for Star Ltd with reference to Black Scholes option pricing model, with a dividend payout of $ 2 in 30 days Star Ltd stock price Exercise price Risk free rate Call maturity Stock volatility -$ 60.25 =$50 = 5.24% - 270 days 0.45 e call and put options for Star Ltd with reference to Black Scholes option pricing model, with assumption of no dividend payout Star Ltd stock price Exercise price Risk free rate Call maturity Stock volatility $ 52.75 = 4.88% = 270 days - 0.35 Evaluate and compute call and put options price for Star Ltd with reference to Black Scholes option pricing model, with a dividend payout of $ 2 in 30 days Star Ltd stock price Exercise price Risk free rate Call maturity Stock volatility -$ 60.25 =$50 = 5.24% - 270 days 0.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts