Question: e. Compute the net present value for each project (12 marks) f. Explain the rationale behind the NPV method. (3 marks) g. Discuss how the

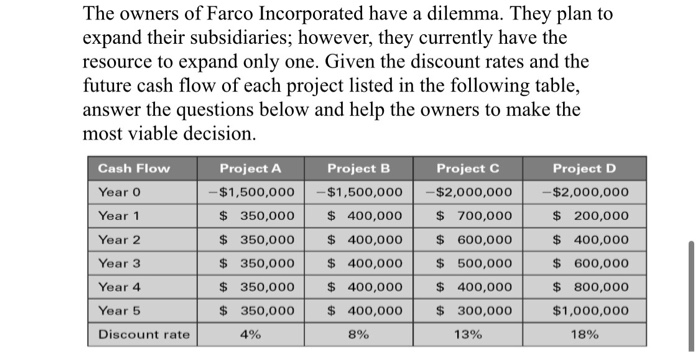

e. Compute the net present value for each project (12 marks) f. Explain the rationale behind the NPV method. (3 marks) g. Discuss how the company would use the NPV method to rank mutually exclusive projects. (3 marks) h. Calculate the profitability index and state the decision for each project. (8 marks) i. Based on each capital budgeting decision model, advice the company about the best project to undertake. The owners of Farco Incorporated have a dilemma. They plan to expand their subsidiaries; however, they currently have the resource to expand only one. Given the discount rates and the future cash flow of each project listed in the following table, answer the questions below and help the owners to make the most viable decision. Cash Flow Year o Year 1 Year 2 Project A -$1,500,000 $ 350,000 $ 350,000 $ 350,000 $ 350,000 $ 350,000 4% Project B - $1,500,000 $ 400,000 $ 400,000 $ 400,000 $ 400,000 $ 400,000 8% Project -$2,000,000 $ 700,000 $ 600,000 $ 500,000 $ 400,000 $ 300,000 13% Project D -$2,000,000 $ 200,000 $ 400,000 $ 600,000 $ 800,000 $1,000,000 18% | Year 3 Year 4 Year 5 Discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts