Question: e) Consider the three stocks: A, B, and C in the following table. P represents price and Q represents shares outstanding. Stock C splits two

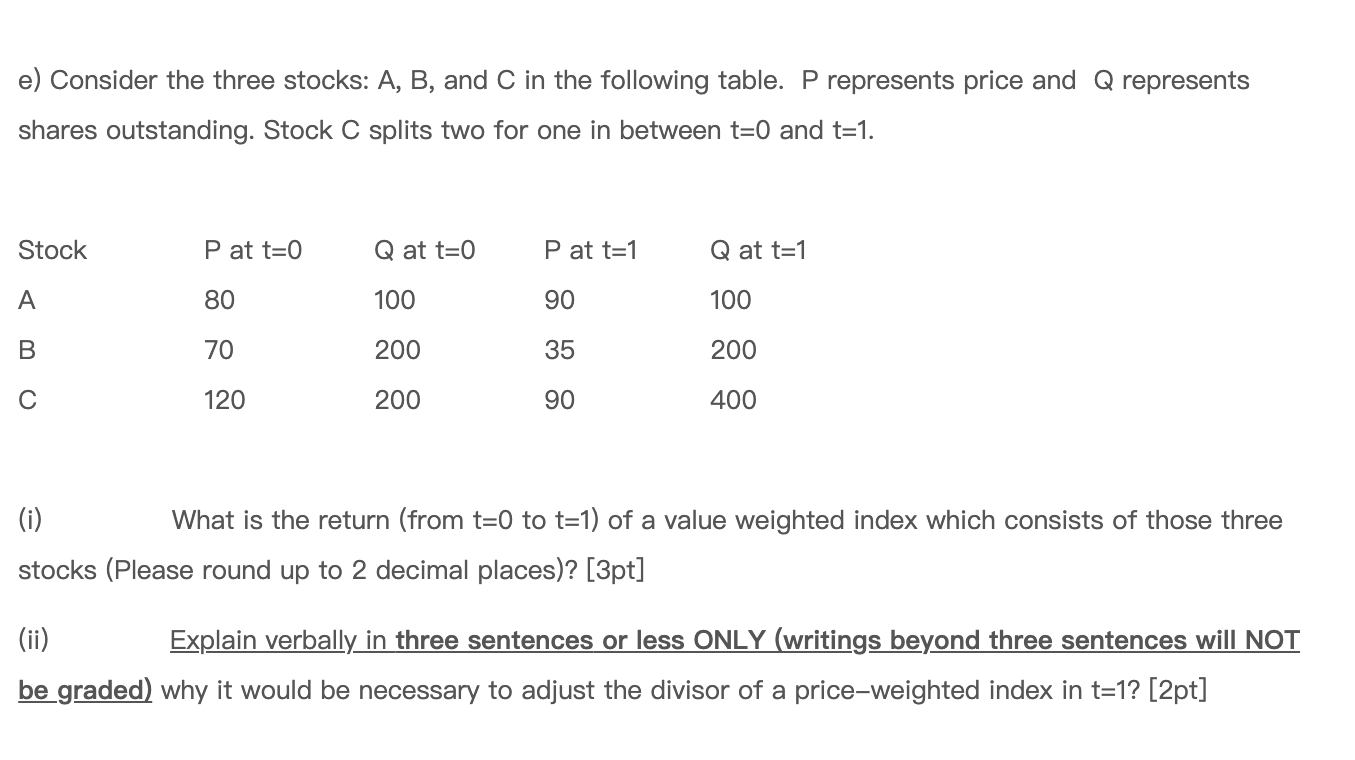

e) Consider the three stocks: A, B, and C in the following table. P represents price and Q represents shares outstanding. Stock C splits two for one in between t=0 and t=1. Stock P at t=0 Q at t=0 Pat t=1 Q at t=1 A 80 100 90 100 B 70 200 35 200 120 200 90 400 (i) What is the return (from t=0 to t=1) of a value weighted index which consists of those three stocks (Please round up to 2 decimal places)? [3pt] (ii) Explain verbally in three sentences or less ONLY (writings beyond three sentences will NOT be graded) why it would be necessary to adjust the divisor of a price-weighted index in t=1? [2pt]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock