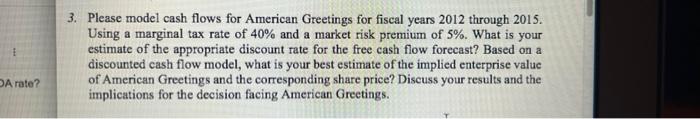

Question: E DA rate? 3. Please model cash flows for American Greetings for fiscal years 2012 through 2015. Using a marginal tax rate of 40% and

E DA rate? 3. Please model cash flows for American Greetings for fiscal years 2012 through 2015. Using a marginal tax rate of 40% and a market risk premium of 5%. What is your estimate of the appropriate discount rate for the free cash flow forecast? Based on a discounted cash flow model, what is your best estimate of the implied enterprise value of American Greetings and the corresponding share price? Discuss your results and the implications for the decision facing American Greetings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock