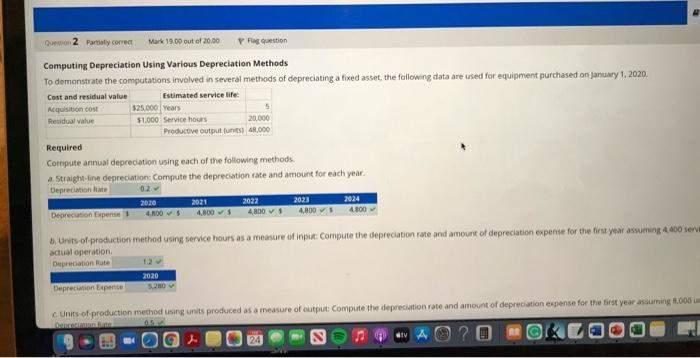

Question: e) Double-declining-balance method: compute the depreciation amount year 2024 2 Partly correc Mark 19.00 out of 20.00 Pag question Computing Depreciation Using Various Depreciation Methods

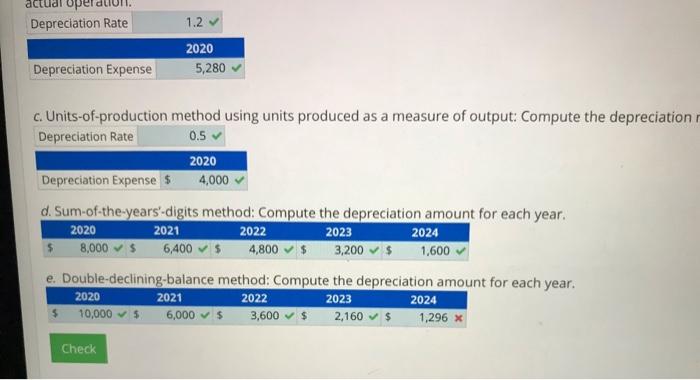

2 Partly correc Mark 19.00 out of 20.00 Pag question Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset the following data are used for equipment purchased on January 1, 2020 Cost and residual value Estimated service life Acquisition cost 125.000 Years Residual value 51.000 Service hours 20.000 Productive outputs) 4,000 Required Compute annual depreciation using each of the following methods. Straight-line deprecation: Compute the depreciation rate and amount for each year, Depreciation State 02 2020 2021 2022 2023 2024 Depreciation Expense 4,800 $ 400 V 4.800 4800 Units of production method using service hours as a measure of input Compute the depreciation rate and amount of depreciation expense for the first year assuming 4400 serv actual operation Depreciation Rate 2020 Depreciation Experte 20 c Units of production method using units produced as a measure of output: Compute the depreciation rate and amount of depreciation expense for the first year assuming .000 Remem Depreciation Rate 1.2 2020 5,280 Depreciation Expense a 0.5 c. Units-of-production method using units produced as a measure of output: Compute the depreciation Depreciation Rate 2020 Depreciation Expense $ 4,000 $ d. Sum-of-the-years-digits method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 8,000 $ 6,400 $ 4,800 $ 3,200 $ 1,600 e. Double-declining balance method: Compute the depreciation amount for each year. 2022 2023 2024 10,000 6,000 $ 3,600 $ 2,160 $ 1,296 * 2020 2021 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts