Question: = E = = E mphasis 1 Heading 1 1 Heading 2 1 Heading 3 THeading 4 Heading 5 1 Paragraph Styles QUESTION 3-Receivables (28)

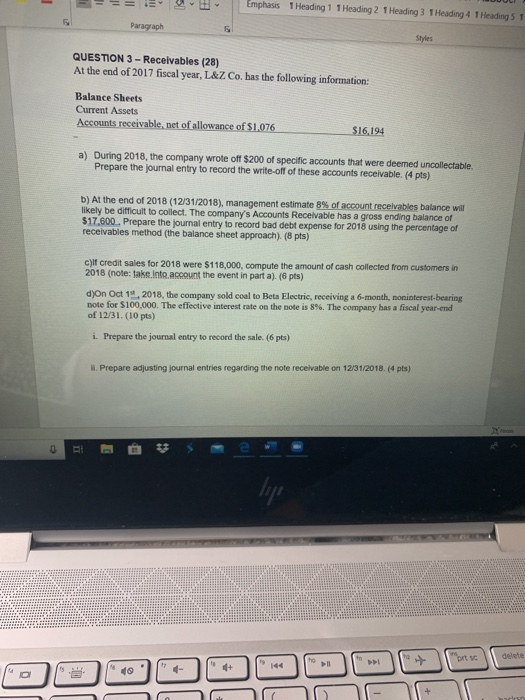

= E = = E mphasis 1 Heading 1 1 Heading 2 1 Heading 3 THeading 4 Heading 5 1 Paragraph Styles QUESTION 3-Receivables (28) At the end of 2017 fiscal year, L&Z Co. has the following information: Balance Sheets Current Assets Accounts receivable, net of allowance of $1,076 $16,194 a) During 2018, the company wrote off $200 of specific accounts that were deemed uncollectable. Prepare the journal entry to record the write-off of these accounts receivable. (4 pts) b) At the end of 2018 (12/31/2018), management estimate 8% of account receivables balance will likely be difficult to collect. The company's Accounts Receivable has a gross ending balance of $17.600. Prepare the journal entry to record bad debt expense for 2018 using the percentage of receivables method (the balance sheet approach). (8 pts) c)If credit sales for 2018 were $118,000, compute the amount of cash collected from customers in 2018 (note: take into account the event in part a). (6 pts) d)On Oct 1, 2018, the company sold coal to Beta Electric, receiving a 6-month, noninterest-bearing note for $100,000. The effective interest rate on the note is 8%. The company has a fiscal year-end of 12/31. (10 pts) i. Prepare the journal entry to record the sale. (6 pts) H. Prepare adjusting journal entries regarding the note receivable on 12/31/2018.(4 pts) OOOOOOOOC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts