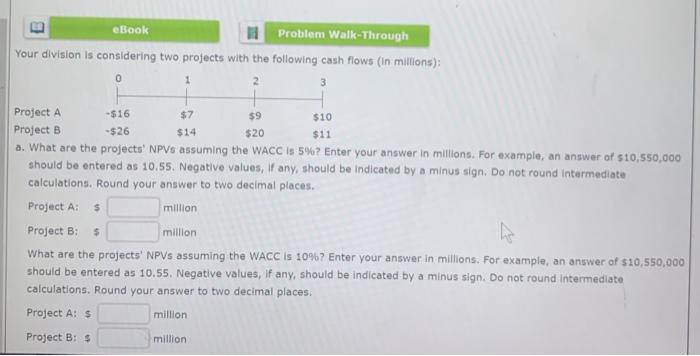

Question: E eBook Problem Walk-Through Your division is considering two projects with the following cash flows (in millions): 1 2 0 3 -$16 Project A $7

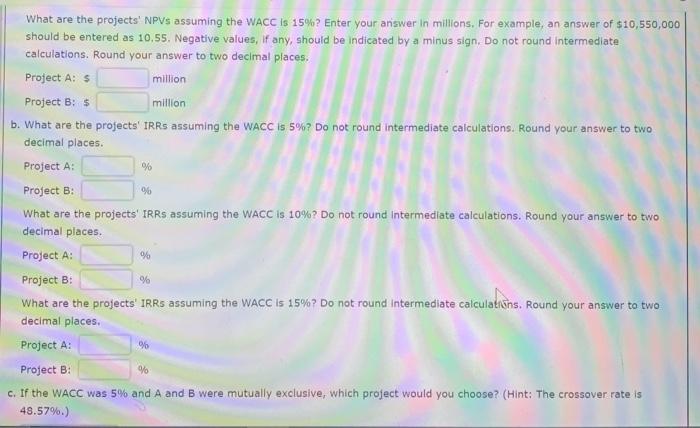

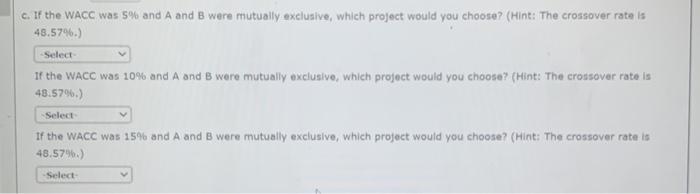

E eBook Problem Walk-Through Your division is considering two projects with the following cash flows (in millions): 1 2 0 3 -$16 Project A $7 $9 $10 Project B -$26 $14 $20 $11 a. What are the projects' NPVs assuming the WACC is 5%? Enter your answer in millions. For example, an answer of s10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. Project A: $ million Project B: million What are the projects' NPVs assuming the WACC is 10%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. Project A: $ million $ Project B: $ million % 96 What are the projects' NPVs assuming the WACC is 15%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to two decimal places. Project A: $ million Project B: $ million b. What are the projects' IRRs assuming the WACC is 5%? Do not round intermediate calculations. Round your answer to two decimal places Project A: Project B: What are the projects' IRRs assuming the WACC is 10%? Do not round Intermediate calculations. Round your answer to two decimal places. Project A: Project B: What are the projects' IRRs assuming the WACC is 15%? Do not round Intermediate calculations. Round your answer to two decimal places Project A: Project B: c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 48.57%.) %% % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts