Question: e Exercise 12-42 (Static) Straightforward Capital Budgeting with Taxes (Non-MACRS-Based Depreciation); Sensitivity Analysis [LO 12-4, 12-5, 12-6] Dorothy & George Company is planning to acquire

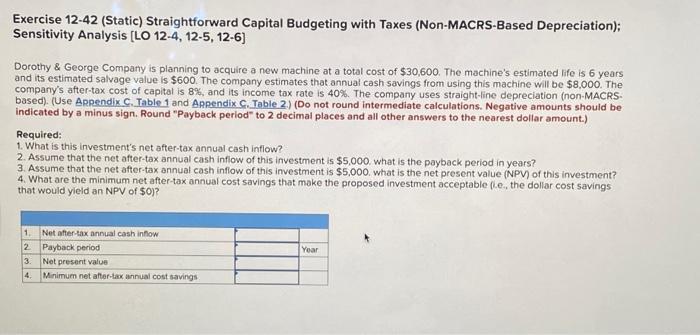

Exercise 12-42 (Static) Straightforward Capital Budgeting with Taxes (Non-MACRS-Based Depreciation); Sensitivity Analysis [LO 12-4, 12-5, 12-6] Dorothy & George Company is planning to acquire a new machine at a total cost of $30,600. The machine's estimated life is 6 years and its estimated salvage value is $600. The company estimates that annual cash savings from using this machine will be $8,000. The company's after-tax cost of capital is 8%, and its income tax rate is 40%. The company uses straight-line depreciation (non-MACRS. based). (Use ARpendix. C. Table 1 and Appendix C.Table. 2.) (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Round "Payback period" to 2 decimal places and all other answers to the nearest dollar amount.) Required: 1. What is this investment's net after-tax annual cash infiow? 2. Assume that the net after-tax annual cash infiow of this investment is $5,000. what is the payback period in years? 3. Assume that the net after-tax annual cash inflow of this investment is $5,000. what is the net present value (NPV) of this investment? 4. What are the minimum net after-tax annual cost savings that make the proposcd investment acceptable (Le., the dollar cost savings that would yield an NPV of $0 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts