Question: E - Eyes.com just issued some new 2 0 / 2 0 preferred stock. The issue will pay an annual dividend of $ 1 2

EEyes.com just issued some new preferred stock. The issue will pay an annual dividend of $ in perpetuity, beginning years from now. If the market requires a return of percent on this investment, how much does a share of preferred stock cost today? Do not round intermediate calculations and round your answer to decimal places, eg

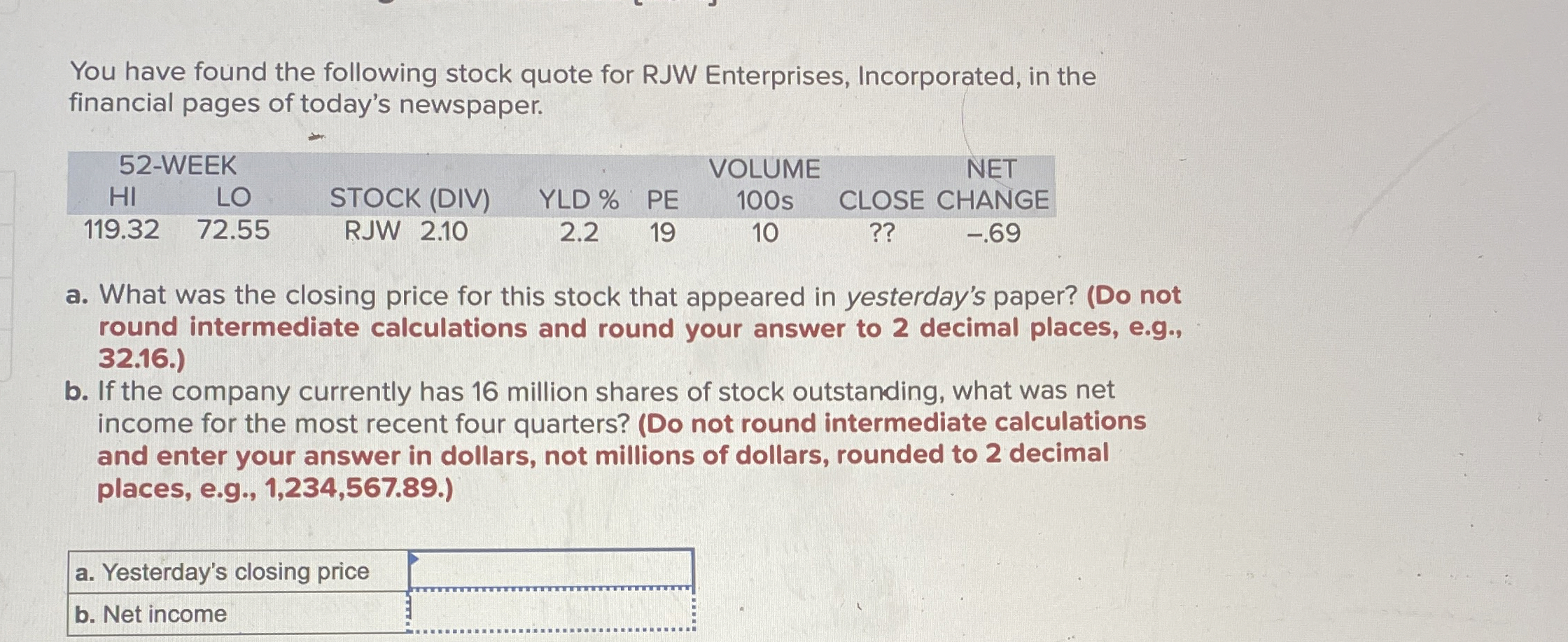

You have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages of today's newspaper.

tableWEEK,,,VOLUME,NETHILOSTOCK DIVYLD PEsCLOSE,CHANGERJW

a What was the closing price for this stock that appeared in yesterday's paper? Do not round intermediate calculations and round your answer to decimal places, eg

b If the company currently has million shares of stock outstanding, what was net income for the most recent four quarters? Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to decimal places, eg

tablea Yesterday's closing price,b Net income,

You have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages of today's newspaper.

tableWEEK,,,VOLUME,NETHILOSTOCK DIVYLD PEsCLOSE,CHANGERJW

a What was the closing price for this stock that appeared in yesterday's paper? Do not round intermediate calculations and round your answer to decimal places, eg

b If the company currently has million shares of stock outstanding, what was net income for the most recent four quarters? Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to decimal places, eg

tablea Yesterday's closing price,b Net income,

You have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages of today's newspaper.

tableWEEK,,,VOLUME,NETHILOSTOCK DIVYLD PEsCLOSE,CHANGERJW

a What was the closing price for this stock that appeared in yesterday's paper? Do not round intermediate calculations and round your answer to decimal places, eg

b If the company currently has million shares of stock outstanding, what was net income for the most recent four quarters? Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to decimal places, eg

tablea Yesterday's closing price,b Net income,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock