Question: e. Figure 1 depicts the expected returns and standard deviations for five assets. Which assets are not dominated by any other asset? Please answer E,

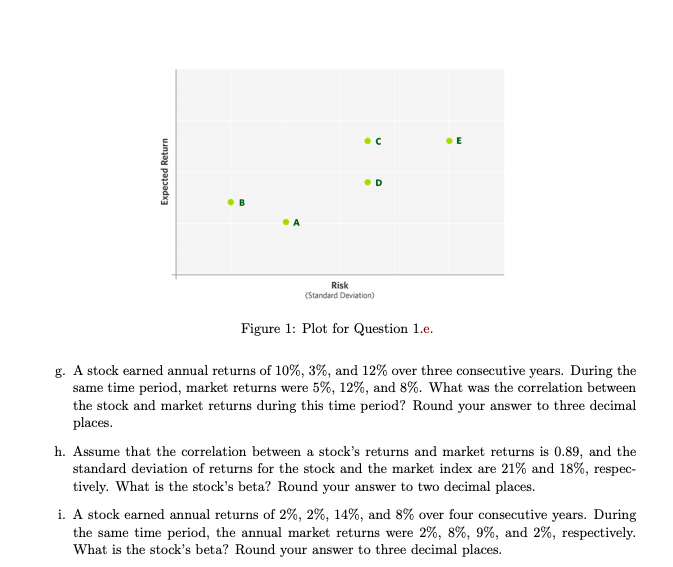

e. Figure 1 depicts the expected returns and standard deviations for five assets. Which assets are not dominated by any other asset?

Please answer E, G, H, I. Show work where you can so I can better understand the solution.

Thanks.

Expected Return Risk (Standard Deviation) Figure 1: Plot for Question 1.e. g. A stock earned annual returns of 10%, 3%, and 12% over three consecutive years. During the same time period, market returns were 5%, 12%, and 8%. What was the correlation between the stock and market returns during this time period? Round your answer to three decimal places. h. Assume that the correlation between a stock's returns and market returns is 0.89, and the standard deviation of returns for the stock and the market index are 21% and 18%, respec- tively. What is the stock's beta? Round your answer to two decimal places. i. A stock earned annual returns of 2%, 2%, 14%, and 8% over four consecutive years. During the same time period, the annual market returns were 2%, 8%, 9%, and 2%, respectively. What is the stock's beta? Round your answer to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts