Question: E Grades for Kareem Algatami: B x Test 1 Ch 1 - 3 Part 2 X C Get Homework Help With Che x + C

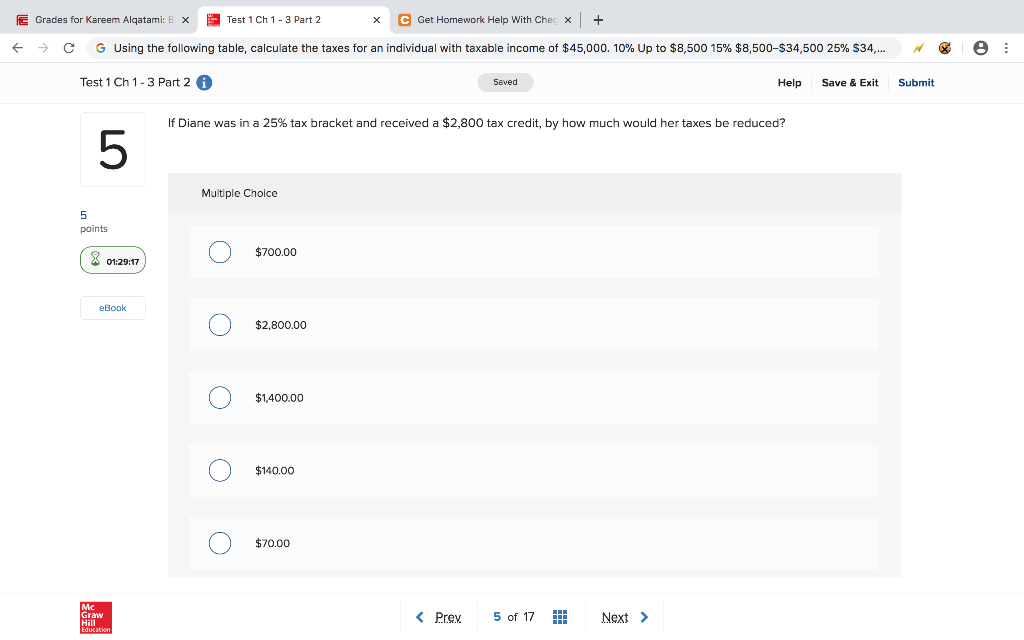

E Grades for Kareem Algatami: B x Test 1 Ch 1 - 3 Part 2 X C Get Homework Help With Che x + C G Using the following table, calculate the taxes for an individual with taxable income of $45,000. 10% Up to $8,500 15% $8,500-$34,500 25% $34.... e Test 1 Ch 1 - 3 Part 2 i Seved Help Save & Exit Submit If Diane was in a 25% tax bracket and received a $2,800 tax credit, by how much would her taxes be reduced? Multiple Choice points 18 01:29:17 O $700.00 eBook O $2,800.00 O $1,400.00 O $140.00 O $70.00 Graw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts