Question: E Homework: Chapter 11 Homework Question 16, P11-34 (si... Part 1 of a HW Score: 25%, 4 of 16 points O Points: 0 of 1

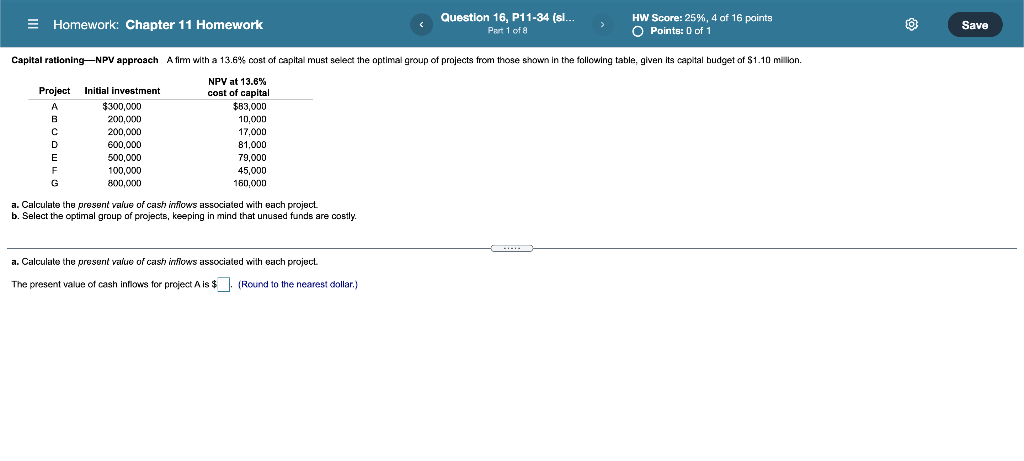

E Homework: Chapter 11 Homework Question 16, P11-34 (si... Part 1 of a HW Score: 25%, 4 of 16 points O Points: 0 of 1 Save Capital rationing NPV approach A fim with a 13.6% cost of capital must select the optimal group of projects from those shown in the following table, given its capital budget of $1.10 million. NPV at 13.6% Project Initial investment cost of capital A $300.000 $83.000 B 200,000 10,000 C 200.000 17.000 D 600,000 81,000 E 500,000 79,000 F 100,000 45.000 G 800,000 160,000 a. Calculate the present value of cash inflows associated with each project b. Select the optimal group of projects, keeping in mind that unused funds are costly. a. Calculate the present value of cash indows associated with each project The present value of cash inflows for project Ais $(Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts