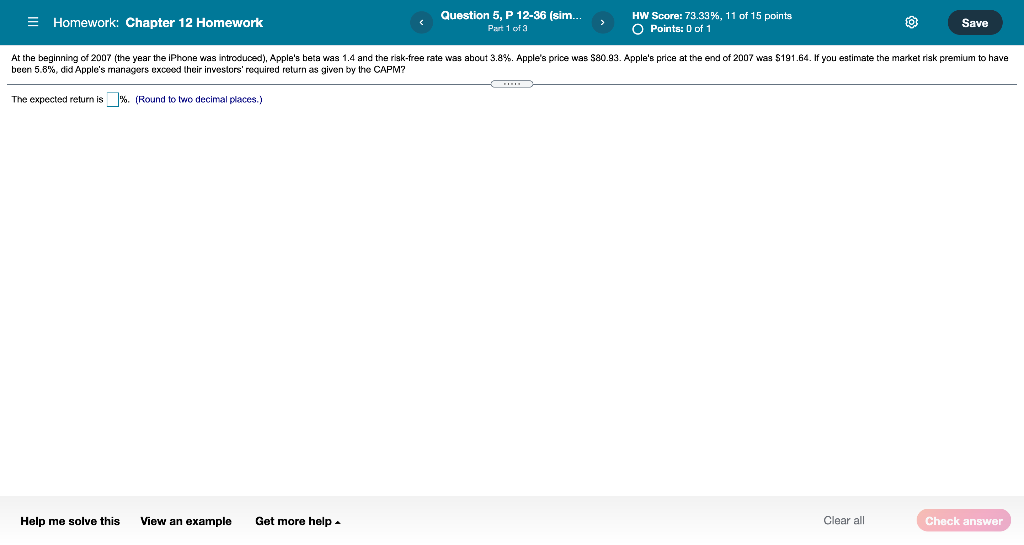

Question: E Homework: Chapter 12 Homework Question 5, P 12-36 (sim. Part 1 of a HW Score: 73.33%, 11 of 15 points Points: 0 of 1

E Homework: Chapter 12 Homework Question 5, P 12-36 (sim. Part 1 of a HW Score: 73.33%, 11 of 15 points Points: 0 of 1 0 Save At the beginning of 2007 (the year the iPhone was introduced), Apple's beta was 1.4 and the risk-free rate was about 3.8%. Apple's price was $80.93. Apple's price at the end of 2007 was $191.64. If you estimate the market risk premium to have been 5.8%, did Apple's managers exceed their investors' required return as given by the CAPM? The expected return is % (Round to two decimal places.) Help me solve this View an example Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts