Question: E Homework: CHAPTER 16 HOME ASSIGNMENT Question 6, E16-56 (similar to) HW Score: 35.19%, 7.04 of 20 points Save Part 1 of 4 O Points:

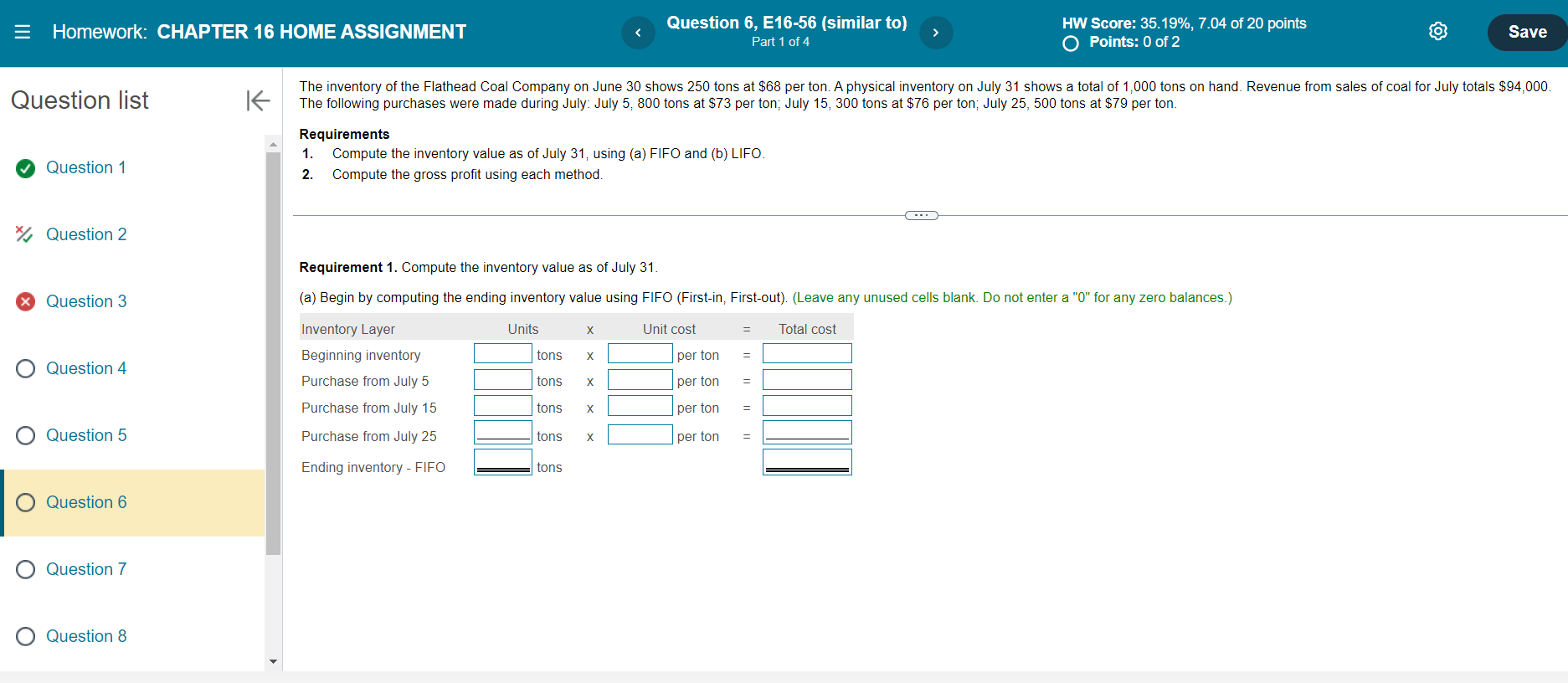

E Homework: CHAPTER 16 HOME ASSIGNMENT Question 6, E16-56 (similar to) HW Score: 35.19%, 7.04 of 20 points Save Part 1 of 4 O Points: 0 of 2 The inventory of the Flathead Coal Company on June 30 shows 250 tons at $68 per ton. A physical inventory on July 31 shows a total of 1,000 tons on hand. Revenue from sales of coal for July totals $94,000. Question list K The following purchases were made during July: July 5, 800 tons at $73 per ton; July 15, 300 tons at $76 per ton; July 25, 500 tons at $79 per ton. Requirements 1. Compute the inventory value as of July 31, using (a) FIFO and (b) LIFO. Question 1 2. Compute the gross profit using each method. Question 2 Requirement 1. Compute the inventory value as of July 31. X Question 3 (a) Begin by computing the ending inventory value using FIFO (First-in, First-out). (Leave any unused cells blank. Do not enter a "0" for any zero balances.) Inventory Layer Units X Unit cost E Total cost Beginning inventory tons X per ton = Question 4 Purchase from July 5 tons X per ton = Purchase from July 15 tons X per ton = O Question 5 Purchase from July 25 tons X per ton = Ending inventory - FIFO tons O Question 6 O Question 7 O Question 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts