Question: E Homework: Chapter 3 Homework Question 1, P3-2 (similar ... Part 1 of 4 HW Score: 0%, 0 of 11 points Score: 0 of 1

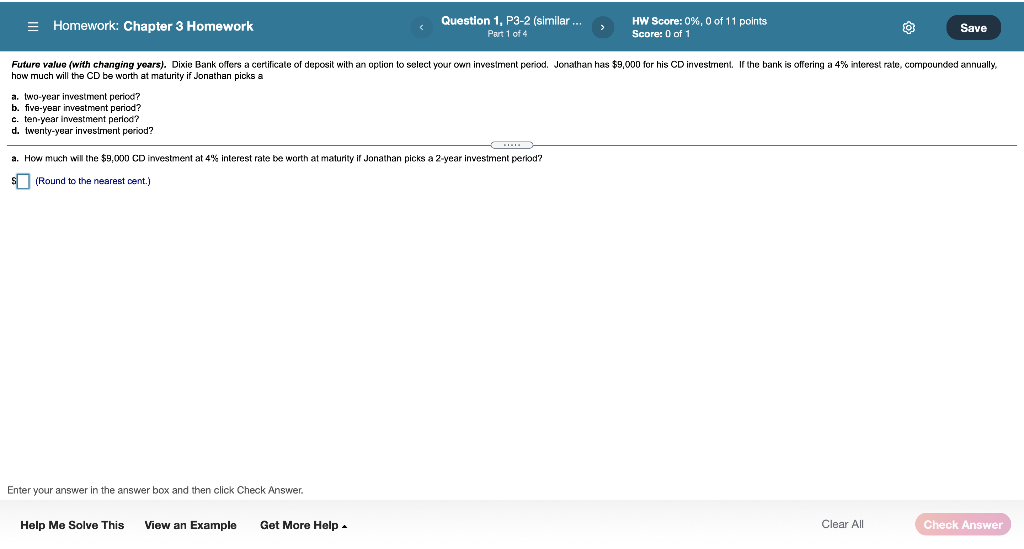

E Homework: Chapter 3 Homework Question 1, P3-2 (similar ... Part 1 of 4 HW Score: 0%, 0 of 11 points Score: 0 of 1 O Save select your Future value (with changing years). Dixie Bank offers a certificate of deposit with an option how much will the CD be worth at maturity if Jonathan picks a investment period. Jonathan has $9,000 for his CD investment. If the bank is offering a 4% interest rate, compounded annually, a. two-year investment period? b. five-year investment period? c. ten-year investment period? d. twenty-year investment period? a. How much will the $9,000 CD investment at 4% interest rate be worth at maturity ir Jonathan picks a 2-year investment period? (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts