Question: E Homework: Chapter 4 Homework Question 14, 4.E.59 HW Score: 38.3%, 5.74 of 15 po Part 1 of 3 Points: 0 of 1 Consider the

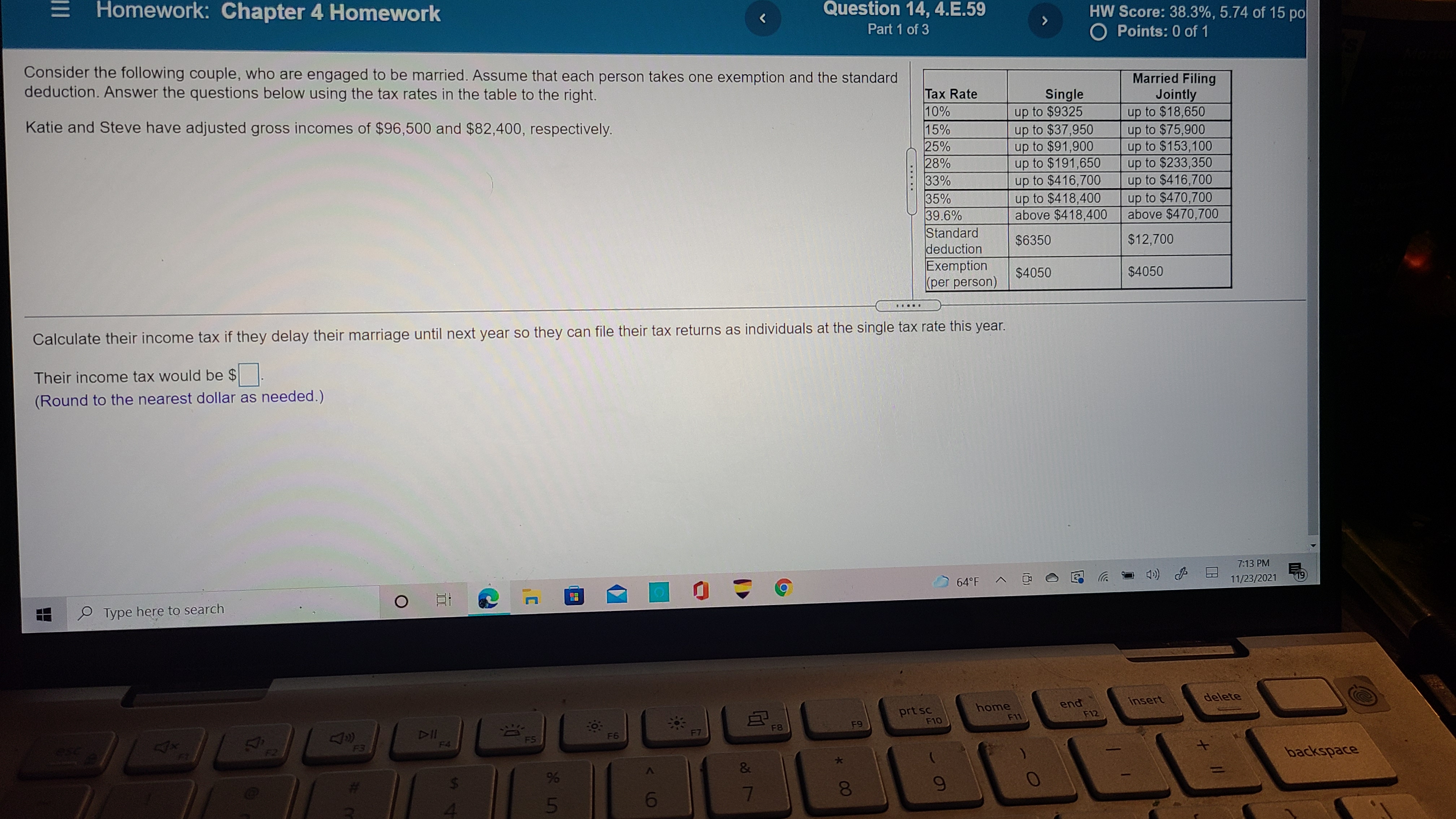

E Homework: Chapter 4 Homework Question 14, 4.E.59 HW Score: 38.3%, 5.74 of 15 po Part 1 of 3 Points: 0 of 1 Consider the following couple, who are engaged to be married. Assume that each person takes one exemption and the standard deduction. Answer the questions below using the tax rates in the table to the right. Married Filing Tax Rate Single Jointly 10% Katie and Steve have adjusted gross incomes of $96,500 and $82,400, respectively. up to $9325 up to $18,650 15% up to $37,950 up to $75,900 25% up to $91,900 up to $153, 100 28% up to $191,650 up to $233,350 33%% up to $416,700 up to $416,700 35% up to $418,400 up to $470,700 39.6% above $418,400 above $470,700 Standard deduction $6350 $12,700 Exemption $4050 $4050 (per person) Calculate their income tax if they delay their marriage until next year so they can file their tax returns as individuals at the single tax rate this year. Their income tax would be $ (Round to the nearest dollar as needed.) 7:13 PM 64 0 F ~ 0 0 6 621) 11/23/2021 19 Type here to search O prt sc home end insert delete F11 F12 F9 F10 F7 F3 E4 F5 F6 F2 K backspace % 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts