Question: e Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 12 AA E ab Wrap Te te B I UV DV Av

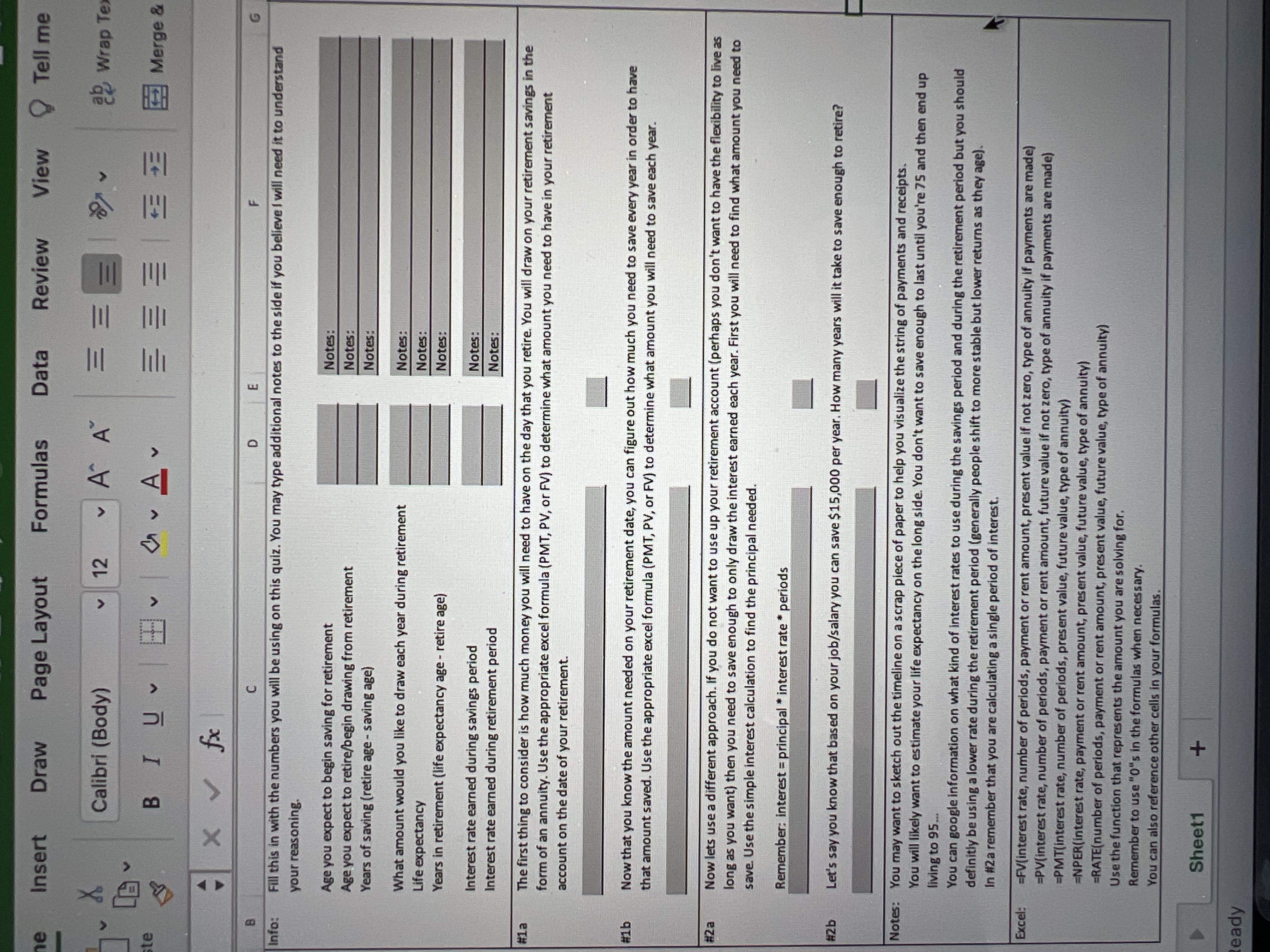

e Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 12 AA E ab Wrap Te te B I UV DV Av E Merge & X V fx B C D E F G Info: Fill this in with the numbers you will be using on this quiz. You may type additional notes to the side if you believe I will need it to understand your reasoning Age you expect to begin saving for retirement Notes: Age you expect to retire/begin drawing from retirement Notes: Years of saving (retire age - saving age) Notes: What amount would you like to draw each year during retirement Notes: Life expectancy Notes: Years in retirement (life expectancy age - retire age) Notes: Interest rate earned during savings period Notes: Interest rate earned during retirement period Notes: #1a The first thing to consider is how much money you will need to have on the day that you retire. You will draw on your retirement savings in the form of an annuity. Use the appropriate excel formula (PMT, PV, or FV) to determine what amount you need to have in your retirement account on the date of your retirement. #1b Now that you know the amount needed on your retirement date, you can figure out how much you need to save every year in order to have that amount saved. Use the appropriate excel formula (PMT, PV, or FV) to determine what amount you will need to save each year. #22 Now lets use a different approach. If you do not want to use up your retirement account (perhaps you don't want to have the flexibility to live as long as you want) then you need to save enough to only draw the interest earned each year. First you will need to find what amount you need to save. Use the simple interest calculation to find the principal needed. Remember: interest = principal * interest rate * periods #2b Let's say you know that based on your job/salary you can save $15,000 per year. How many years will it take to save enough to retire? Notes: You may want to sketch out the timeline on a scrap piece of paper to help you visualize the string of payments and receipts. You will likely want to estimate your life expectancy on the long side. You don't want to save enough to last until you're 75 and then end up living to 95... You can google information on what kind of interest rates to use during the savings period and during the retirement period but you should definitly be using a lower rate during the retirement period (generally people shift to more stable but lower returns as they age). In #2a remember that you are calculating a single period of interest. Excel: =FV(interest rate, number of periods, payment or rent amount, present value if not zero, type of annuity if payments are made) PV(interest rate, number of periods, payment or rent amount, future value if not zero, type of annuity if payments are made) PMT(interest rate, number of periods, present value, future value, type of annuity) =NPER(interest rate, payment or rent amount, present value, future value, type of annuity) =RATE(number of periods, payment or rent amount, present value, future value, type of annuity) Use the function that represents the amount you are solving for. Remember to use "O's in the formulas when necessary. You can also reference other cells in your formulas. Sheet1 + eady

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts