Question: E. is the correct answer but im not understanding the theory behind why the other questions are wrong. please give an explanation why the other

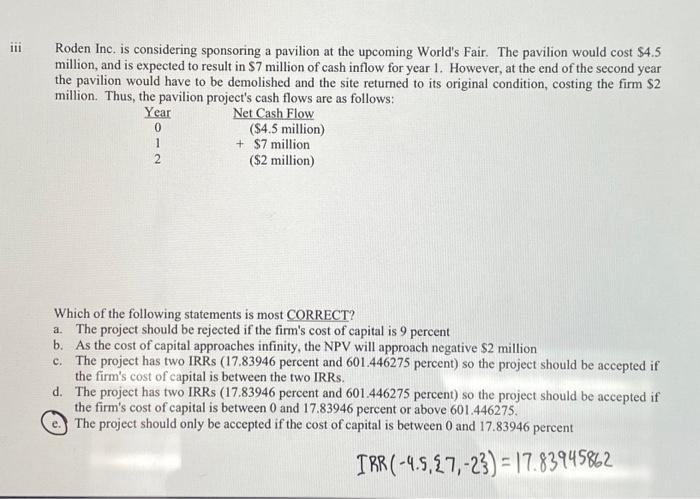

Roden Inc. is considering sponsoring a pavilion at the upcoming World's Fair. The pavilion would cost $4.5 million, and is expected to result in $7 million of cash inflow for year 1 . However, at the end of the second year the pavilion would have to be demolished and the site returned to its original condition, costing the firm $2 million. Thus, the pavilion project's cash flows are as follows: Which of the following statements is most CORRECT? a. The project should be rejected if the firm's cost of capital is 9 percent b. As the cost of capital approaches infinity, the NPV will approach negative $2 million c. The project has two IRRs (17.83946 percent and 601.446275 percent) so the project should be accepted if the firm's cost of capital is between the two IRRs. d. The project has two IRRs (17.83946 percent and 601.446275 percent) so the project should be accepted if the firm's cost of capital is between 0 and 17.83946 percent or above 601.446275 . e. The project should only be accepted if the cost of capital is between 0 and 17.83946 percent IRR(4.5,{7,2})=17.83945862

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts