Question: E) its total debt ex 13) Katlin Markets is debating between a levered and an unlevered capital structure. The all-equity capital structure would consist of

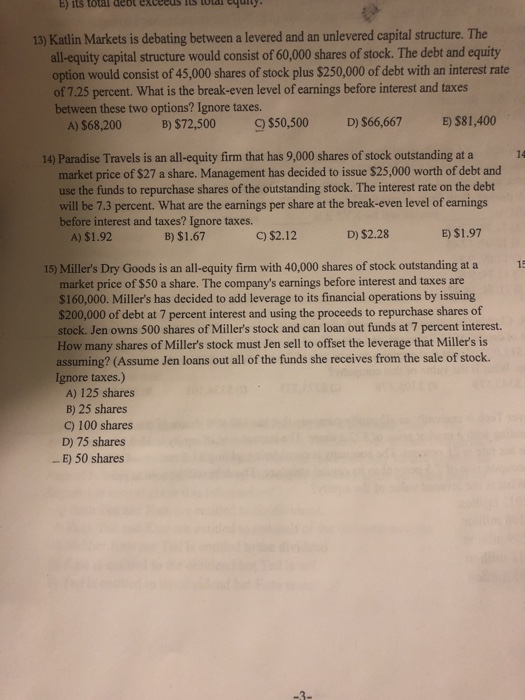

E) its total debt ex 13) Katlin Markets is debating between a levered and an unlevered capital structure. The all-equity capital structure would consist of 60,000 shares of stock. The debt and equity option would consist of 45,000 shares of stock plus $250,000 of debt with an interest rate of 7.25 percent. What is the break-even level of earnings before interest and taxes between these two options? Ignore taxes. A) S68,200 B) S72,500 $50,500 D) $66,667E) $81,400 14) Paradise Travels is an all-equity firm that has 9,000 shares of stock outstanding at a 1 market price of $27 a share. Management has decided to issue $25,000 worth of debt and use the funds to repurchase shares of the outstanding stock. The interest rate on the debt will be 7.3 percent. What are the earnings per share at the break-even level of earnings before interest and taxes? Ignore taxes. A) $1.92 B) $1.67 C) $2.12 D) $2.28 E) $1.97 15) Miller's Dry Goods is an all-equity firm with 40,000 shares of stock outstanding at a market price of $50 a share. The company's earnings before interest and taxes are $160,000. Miller's has decided to add leverage to its financial operations by issuing $200,000 of debt at 7 percent interest and using the proceeds to repurchase shares of stock. Jen owns 500 shares of Miller's stock and can loan out funds at 7 percent interest. How many shares of Miller's stock must Jen sell to offset the leverage that Miller's is assuming? (Assume Jen loans out all of the funds she receives from the sale of stock. Ignore taxes.) A) 125 shares B) 25 shares C) 100 shares D) 75 shares E) 50 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts