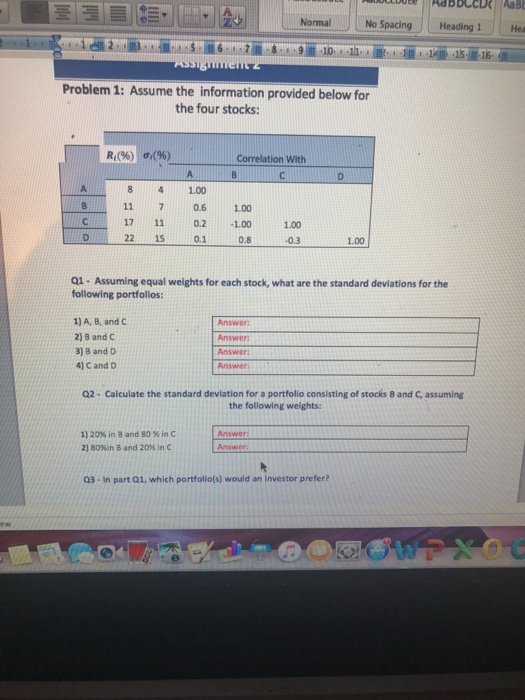

Question: E | , lu ideell Normal | NoSpacing Heading 1 151 15 Problem 1: Assume the information provided below for the four stocks: R, (%)

E | , lu ideell Normal | NoSpacing Heading 1 151 15 Problem 1: Assume the information provided below for the four stocks: R, (%) n(%) Correlation With 8 4 1.00 11 70.6 1.00 17 11 0.2 1.00 1.00 22 1 0.1 0.8 1.00 Q1- Assuming equal weights for each stock, what are the standard deviations for the following portfolios: 1) A, B, and C 2) 8 and C 3) B and D 4) C and D Answer Answer Answer Q2- Calculate the standard deviation for a portfolio consisting of stocks B and C, assuming the following welghts: 1) 20% in B and 80 % in C 2) 80%in B and 20% in C Answer Q3- In part Q1, which portfolio(s) would an investor prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts