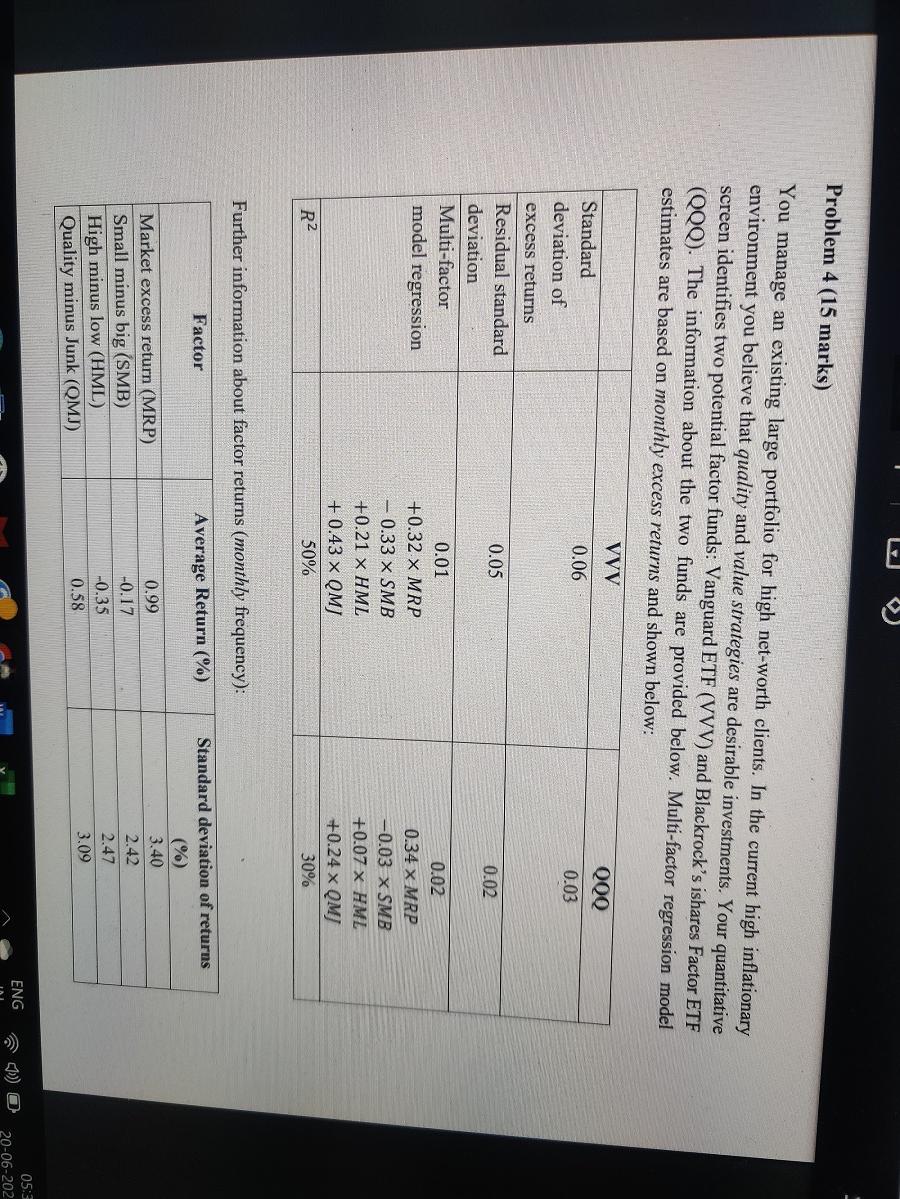

Question: E Problem 4 (15 marks) You manage an existing large portfolio for high net-worth clients. In the current high inflationary environment you believe that quality

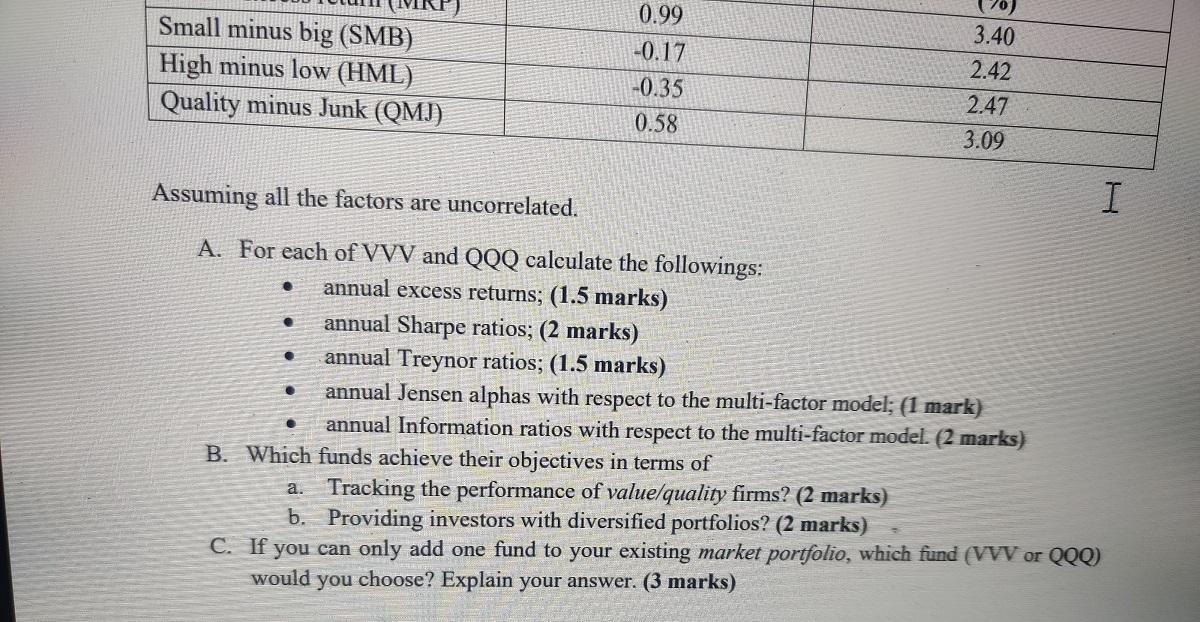

E Problem 4 (15 marks) You manage an existing large portfolio for high net-worth clients. In the current high inflationary environment you believe that quality and value strategies are desirable investments. Your quantitative screen identifies two potential factor funds: Vanguard ETF (VVV) and Blackrock's ishares Factor ETF (QQQ). The information about the two funds are provided below. Multi-factor regression model estimates are based on monthly excess returns and shown below: QQQ Standard deviation of 0.06 0.03 excess returns Residual standard 0.05 0.02 deviation Multi-factor 0.01 0.02 model regression +0.32 MRP 0.34 MRP 0.33 SMB 0.03 SMB +0.21 x HML +0.07 x HML + 0.43 x QMJ +0.24 x QMJ 30% R 50% Further information about factor returns (monthly frequency): Factor Standard deviation of returns Average Return (%) (%) 0.99 3.40 Market excess return (MRP) Small minus big (SMB) 2.42 -0.17 2.47 -0.35 High minus low (HML) 3.09 0.58 Quality minus Junk (QMJ) ENG 05:3 20-06-202 0.99 3.40 -0.17 2.42 Small minus big (SMB) High minus low (HML) Quality minus Junk (QMJ) -0.35 2.47 0.58 3.09 Assuming all the factors are uncorrelated. A. For each of VVV and QQQ calculate the followings: annual excess returns; (1.5 marks) annual Sharpe ratios; (2 marks) annual Treynor ratios; (1.5 marks) annual Jensen alphas with respect to the multi-factor model; (1 mark) annual Information ratios with respect to the multi-factor model. (2 marks) B. Which funds achieve their objectives in terms of a. Tracking the performance of value/quality firms? (2 marks) b. Providing investors with diversified portfolios? (2 marks) C. If you can only add one fund to your existing market portfolio, which fund (VVV or QQQ) would you choose? Explain your answer. (3 marks) I E Problem 4 (15 marks) You manage an existing large portfolio for high net-worth clients. In the current high inflationary environment you believe that quality and value strategies are desirable investments. Your quantitative screen identifies two potential factor funds: Vanguard ETF (VVV) and Blackrock's ishares Factor ETF (QQQ). The information about the two funds are provided below. Multi-factor regression model estimates are based on monthly excess returns and shown below: QQQ Standard deviation of 0.06 0.03 excess returns Residual standard 0.05 0.02 deviation Multi-factor 0.01 0.02 model regression +0.32 MRP 0.34 MRP 0.33 SMB 0.03 SMB +0.21 x HML +0.07 x HML + 0.43 x QMJ +0.24 x QMJ 30% R 50% Further information about factor returns (monthly frequency): Factor Standard deviation of returns Average Return (%) (%) 0.99 3.40 Market excess return (MRP) Small minus big (SMB) 2.42 -0.17 2.47 -0.35 High minus low (HML) 3.09 0.58 Quality minus Junk (QMJ) ENG 05:3 20-06-202 0.99 3.40 -0.17 2.42 Small minus big (SMB) High minus low (HML) Quality minus Junk (QMJ) -0.35 2.47 0.58 3.09 Assuming all the factors are uncorrelated. A. For each of VVV and QQQ calculate the followings: annual excess returns; (1.5 marks) annual Sharpe ratios; (2 marks) annual Treynor ratios; (1.5 marks) annual Jensen alphas with respect to the multi-factor model; (1 mark) annual Information ratios with respect to the multi-factor model. (2 marks) B. Which funds achieve their objectives in terms of a. Tracking the performance of value/quality firms? (2 marks) b. Providing investors with diversified portfolios? (2 marks) C. If you can only add one fund to your existing market portfolio, which fund (VVV or QQQ) would you choose? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts