Question: E Question Help ED Tal Dorpac Corporation has a dividend yield of 1.5%. Its equity cost of capital is 7.9%, and its dividends are expected

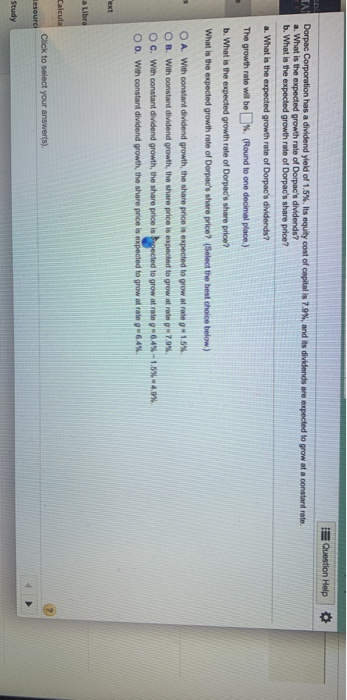

E Question Help ED Tal Dorpac Corporation has a dividend yield of 1.5%. Its equity cost of capital is 7.9%, and its dividends are expected to grow at a constant rato a. What is the expected growth rate of Dorpac's dividends? b. What is the expected growth rate of Dorpac's share price? a. What is the expected growth rate of Dorpac's dividends? The growth rate will be U%. (Round to ono decimal place.) b. What is the expected growth rate of Dorpae's share price? What is the expected growth rate of Dorpad's share price? (Select the best choice below) O A. With constant dividend growth, the share prionis expected to grow atrate 1.5% OB. With constant dividend growth, the share price is expected to grow atrat 70% O C. With constant dividend growth, the share price is spected to grow at rate 6.4% -1.5% 4,9% OD. With constant dividend growth, the share price is expected to grow at rate g 6.4% ext a Libra Calcula Click to select your answer(s). tesouro Study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts